W1M Investment Forum 2025

The W1M Investment Forum, held at BAFTA last week, had a fascinating talk from veteran war correspondent and Sunday Times writer, Christina Lamb, with an illuminating global economic and market context from W1M’s Chief Investment Officer, Bill Dinning, and a very interesting presentation from Asia Pacific Fund Manager Ben Hall on China and its growing technological leadership.

Chistina Lamb described how she went from writing for a Birmingham local paper to travelling, very bravely, with Afghan resistance fighters, when they were fighting the Russians and had western support, to covering the war in Ukraine and, more recently, to writing about tribes facing extinction in the Amazon. Her talk opened the eyes of a London audience to the suffering of some in the world in the past and still today because of the impacts of war, violence and economic challenges. While we did not see the “end of history” when the “iron curtain” fell, and human nature has proven to be far from perfectible but prone to repeating the worst behaviours of history, we have unfortunately, as Christina pointed out, got a world now in which more attention, a larger number of clicks, is gained by newspapers writing about “royals and cats” rather than ongoing geopolitical issues. In her career, Christina has written about how war impacts women and girls particularly and described some of the incredibly brave people she has met, famous and not at all well known, who risk even their lives in the face of adversity. It was clear that maybe the world should pay more attention to those brave people and, if we want the world to hear about them, proper, independent journalism requires people to subscribe to newspapers which commission it. For us at W1M, while meeting investment objectives matters and is our job, the importance of being responsible investors was evident; that is integral to our investment process.

China’s position in the world has changed significantly over Christina’s career and she talked about how the west seems to have withdrawn and left space for China to become a key geopolitical player, particularly in Africa. W1M’s CIO Bill Dinning also spoke about the rise of China as well as the success of the US economy relative to its European developed market peers, leading to far higher economic growth rates and incomes in the US even when compared to Germany, the UK and France; but China is investing to catch up.

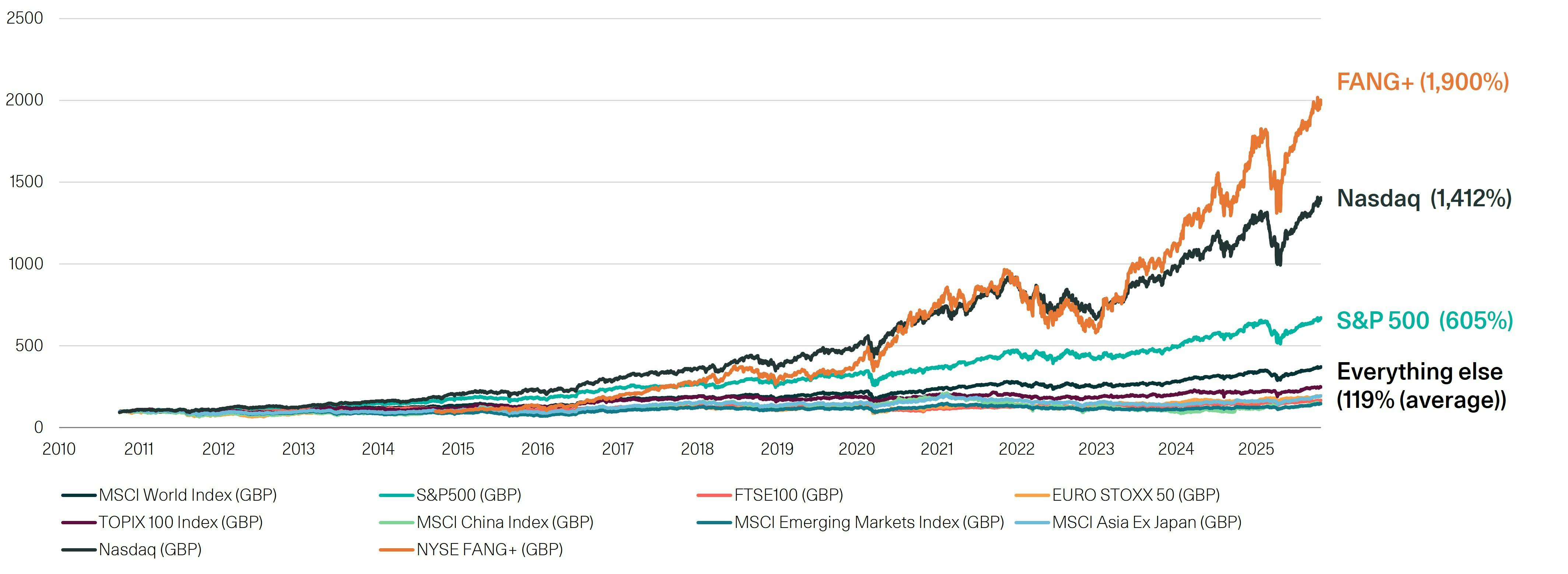

Super equity market performance

Equity index returns

Source: Bloomberg, W1M. Data as at 23rd October 2025.

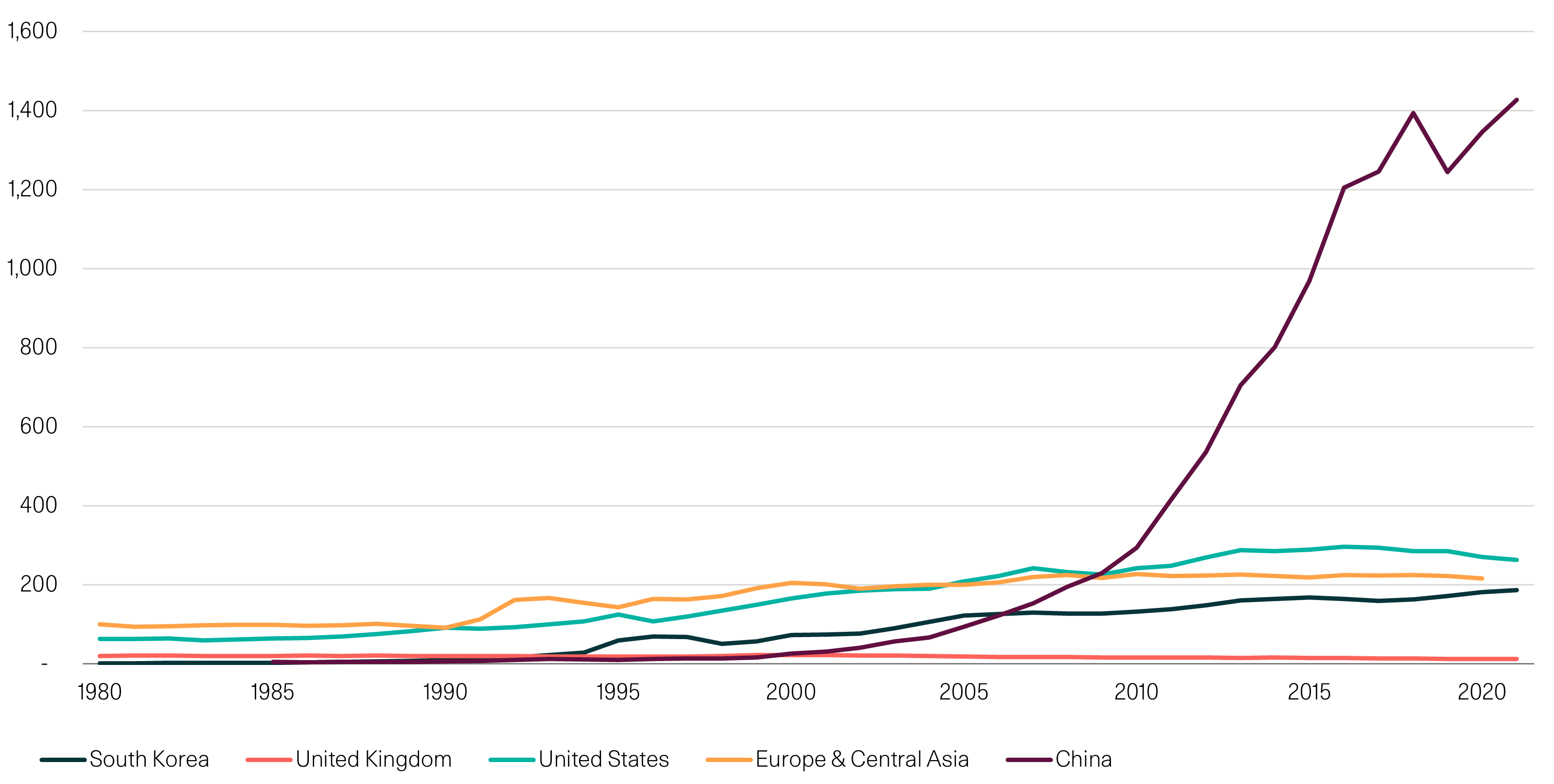

The innovation, entrepreneurialism, capital availability in the US has led to US equity outperformance relative to the rest of the world. There are, however, Bill pointed out, very big changes in global economic competitiveness underway with China not just being a very efficient manufacturer but now also a leading innovator. The chart below illustrates incredible investment and success in Chinese research and development.

Is the US still exceptional? Regional competition

Patent applications (000s)

Source: W1M, Bloomberg. As at 31st December 2024.

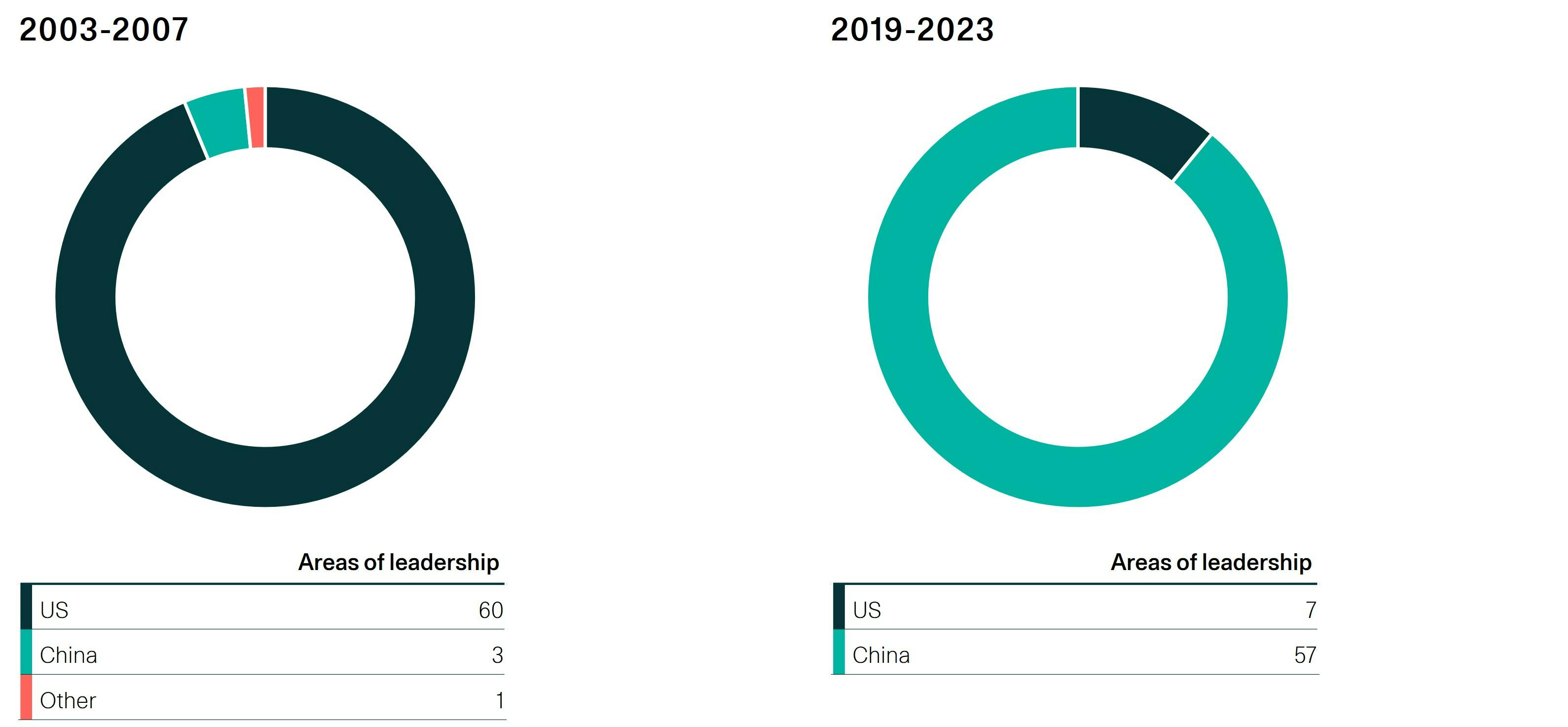

W1M’s Asia Pacific Fund Manager, Ben Hall, built on the theme of China’s changing role in the global economy. Did you know that China now leads in “most cited” critical technology research in quantum technology, advanced materials, energy storage, advanced robotics, biotechnology and, of course, “AI”?

China now leads in "most cited" critical technology research

Leading country globally within 64 critical technological areas:

China is now producing the most impactful research across advanced sectors globally.

‘Critical Technology’ areas include:

– Quantum technology

– Advanced materials

– Energy storage

– Advanced robotics

– Biotechnology

– Artificial Intelligence

Source: W1M, ASPI. As at 31st December 2024.

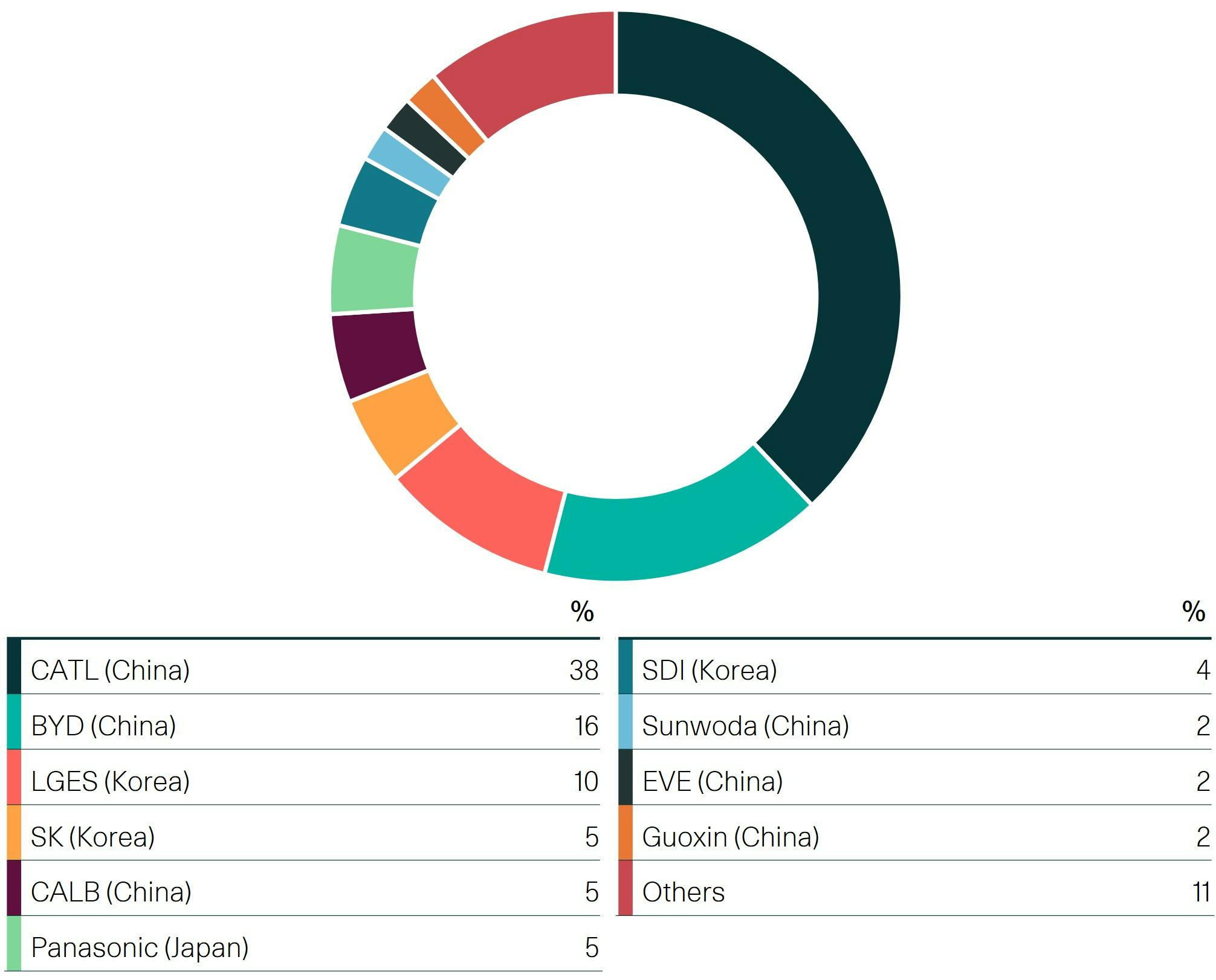

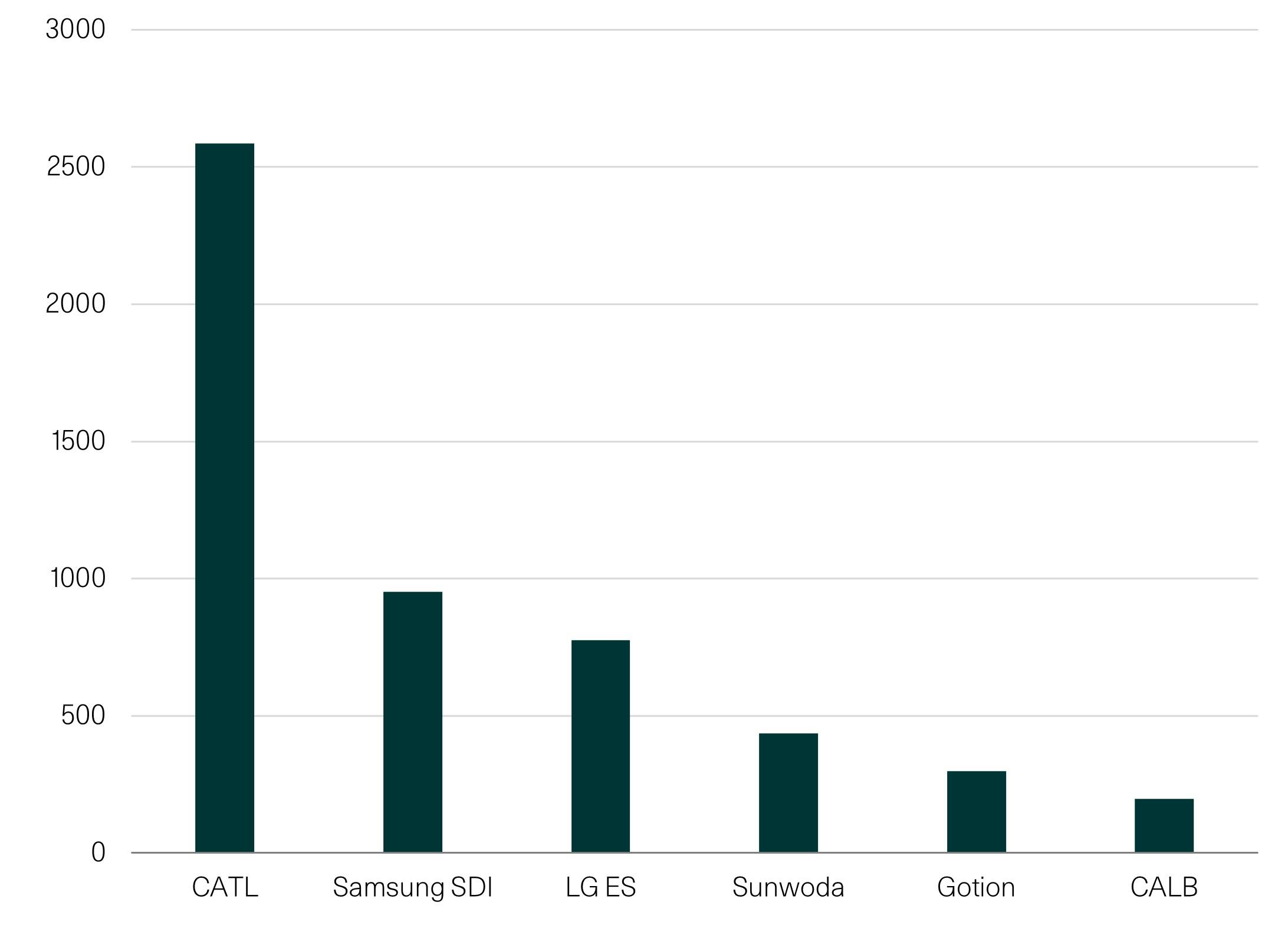

With some Chinese companies now global leaders in their sectors, W1M portfolios do not just hold well known US and European stocks but have direct exposure to winners in Asia. CATL is one example of a company which may not be a household name but is the global leader in advanced battery technology and this is relevant for electric cars as well as for batteries needed to store electricity from wind or solar power. China has not just been heavily investing in R&D but also in supply chains for “rare earths”; this linked to Christina Lamb’s talk and her mentioning of travel through Africa where China’s presence and influence has massively increased this century, both as it builds infrastructure but also as a major customer in mineral rich areas.

CATL

Dominant global leader with 38% market share

Widening their moat through R&D (USDm)

Source: Factset, W1M. Goldman Sachs, Data as at November 2025.

Risk warning: The information above is for information purposes only and should not be considered a solicitation to buy or an offer to sell a security. It is based on our current view of markets and is subject to change.

In a quickly changing world, companies from any region can get into globally dominant positions. Being global, direct and active in our investment approach, W1M is able to look at global sectors and seek to buy the best ideas we find regardless of whether they are listed in the US, China, Europe or other markets. Listening to Christina Lamb, we want to emphasise that we are global, direct, active and responsible too.