The W1M Investment Barometer – November 2025

CIO William Dinning and the W1M Asset Allocation Committee remain constructively positioned into the year end, in a global macro environment which is broadly supportive with interest rates expected to decline in the US, the UK and elsewhere, and company earnings set to be positive. Risks always exist whether considering geopolitics, tariff wars etc but the key questions remain centred on the trajectories of global growth, inflation and interest rates; all of these are relatively benign for markets despite periodically negative headlines. Equities have had a positive year, reflecting that backdrop, while bond yields have been falling recently on moderating inflation expectations, allowing central banks more room to cut interest rates. The importance, in undoubtedly volatile geopolitical times, of having an active protection strategy and inflation resilience in real assets (as embedded in our MPS and multi-asset fund range) is obvious and we remain invested in both. In fixed income, we have had a cautious preference for government bonds relative to corporate credit and remain persuaded that stance is correct.

Equities perhaps are getting most media attention currently because of concentration risks regarding dominance of the “Magnificent 7” technology stocks which represent around a third of US market capitalisation currently. Talk of AI bubbles have been in the news increasingly. We have written recently on “The passive boom and why it could be the next big risk” and remain confident in our global, active and direct approach given we are not buying stocks because they are the biggest companies but selecting shares our analysis suggests have a strong 3+ year theses; this has led to us not holding Nvidia and Tesla but still meeting return objectives.

Magnificent Seven at a record 32% of S&P500 market capitalisation

Magnificent Seven Index as % of market capitalisation of S&P500 Index 2016 - current, weekly

Source: Bloomberg, W1M. As at 17.10.25

Equities: W1M portfolios have benefited from active stock selection with exposure to renewed excitement regarding “AI” and technology, while also remaining conscious of valuations in some stocks. A bottom up, global approach continues to enable our portfolios to deliver against return objectives despite not holding stocks such as Nvidia. Positive stock selection was evident in contributions from AMD, Thermo Fisher, Alphabet, LSEG, AstraZeneca, Rentokil and Hitachi. While some stocks are very expensive, our analysts are able to find many interesting investment opportunities in global sectors as we look ahead to 2026/7.

Global equity stock selection: An example

Research driven stock selection: An example of investments across key areas benefiting from grid modernisation, power demand and renewable buildout:

- Grid

- Power

- Decarbonisation

Risk warning: The above is for example purposes only and should not be considered a solicitation to buy or sell a security.

Source: Company websites, W1M. Data as at 30th June 2025.

Fixed income portfolios have been somewhat cautiously positioned, preferring UK government bonds (gilts) relative to corporate credit and that was well rewarded in October. While not necessarily being negative on credit, we continue to think there could be excessive pessimism on gilts, assuming the UK government can convince markets it will be on track to reduce fiscal deficits over the medium term.

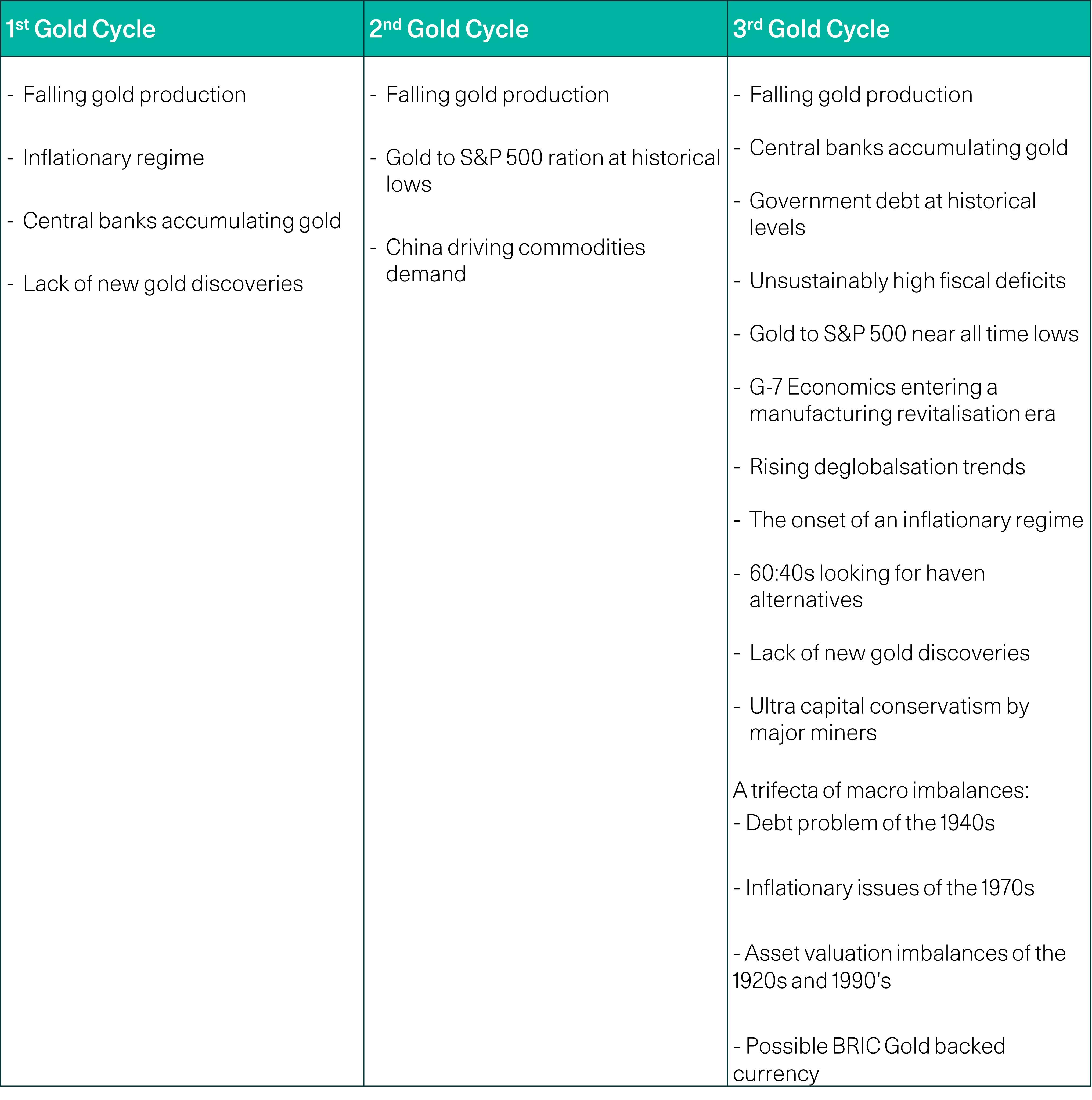

Real Assets: W1M continues to favour real assets over absolute return strategies currently. Gold still looks attractive and is a sensible allocation in our own view, given concerns regarding fiat currency debasement related to ongoing fiscal deficits. The Real Assets Fund offers attractive exposure to inflation-linked cash flows (75% of the portfolio has some inflation linkage) and themes such as the energy transition, power and utilities and digital infrastructure. Real asset valuations have adjusted to the rise in interest rates, while many share prices, particularly within the listed investment company sector, trade at a significant discount to Net Asset Value (NAV).

Gold- entering a new bull market?

The history of gold cycles

Source: Bloomberg, Tavi Costa. As at 30.09.25.

Risk warning: Past performance is no guarantee of future results.

Protection Strategies: building resilience into our multi asset solutions is a key part of our process. Should market volatility increase, say for example in an equity sell off, protection strategies are designed to mitigate negative impacts, i.e. move the other way to equities. If sterling and US equities moved in ways unhelpful to our portfolios, we have strategies designed to ameliorate the situation. Protection strategies can be thought of as “taking insurance” against specific risks.

Summary of our views

November 2025 Asset Allocation Positioning

Risk warning: The above should be used as a guide only. It is based on our current view of markets and is subject to change. As at 22.10.25

Summary

- We remain constructive on prospects for the portfolios of stocks we select together with fixed income, real assets and absolute return exposures held, in an environment with rate cuts expected and the market consensus expecting global growth to remain positive.

- Proper diversification is key given some pockets of high valuation (which may be more relevant for passive funds).

- ‘Risk’ and solving for real world problems is the challenge investors face, as explained by James Mee: “Three things to bear in mind: (1) the secular decline in interest rates is over - bonds simply cannot generate the same returns over the next 30 years as they did in the 30 years to 2022; (2) consistently negative stock/bond correlation is not a given: prior to circa 1998, the relationship was consistently positive; and (3) this 'diversified' portfolio still faced periods of acute and major volatility.”

- CIO Bill Dinning’s latest outlook video is here.

Past performance is not a reliable indicator of future results. The value of investments and the income derived from them may rise as well as fall, and investors may not get back the amount originally invested. Capital security is not guaranteed.

This material is provided for informational purposes only and does not constitute investment advice or a recommendation. It should not be considered an offer to buy or sell any financial instrument or security. Any investment should be made based on a full understanding of the relevant documentation, including a private placement memorandum or offering documents where applicable. W1M Wealth Management Limited is authorised and regulated by both by the Financial Conduct Authority of 12 Endeavour Square, London E20 1JN, with firm reference number 120776 and the U.S. Securities and Exchange Commission of 100 F Street, NE Washington, DC 20549, with firm reference number 801-63787. Registered in England and Wales, Company Number 02080604.

All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without prior written permission from W1M Wealth Management Limited.

Copyright © 2025 W1M Wealth Management Limited.