The W1M Investment Barometer – February 2026

The year has started with various geopolitical challenges but markets have continued to make progress given a still positive macro backdrop. Global growth remains positive and modest interest rate cuts are expected in the US this year. If this changes, perhaps because inflation turns out to be more persistent above target levels than hoped, the environment could be more challenging for both equities and bonds. We remain positive on the medium to longer term prospects for equities and find interesting investment opportunities both in developed and emerging markets. Fixed income offers diversification and yield; government bonds appear relatively attractive compared to corporate debt currently. Gold and other precious metals have seen significant market interest and our portfolios have benefited, but we have taken some profits this year. Deploying protection strategies remains wise, in our view, given geopolitical uncertainty lingers.

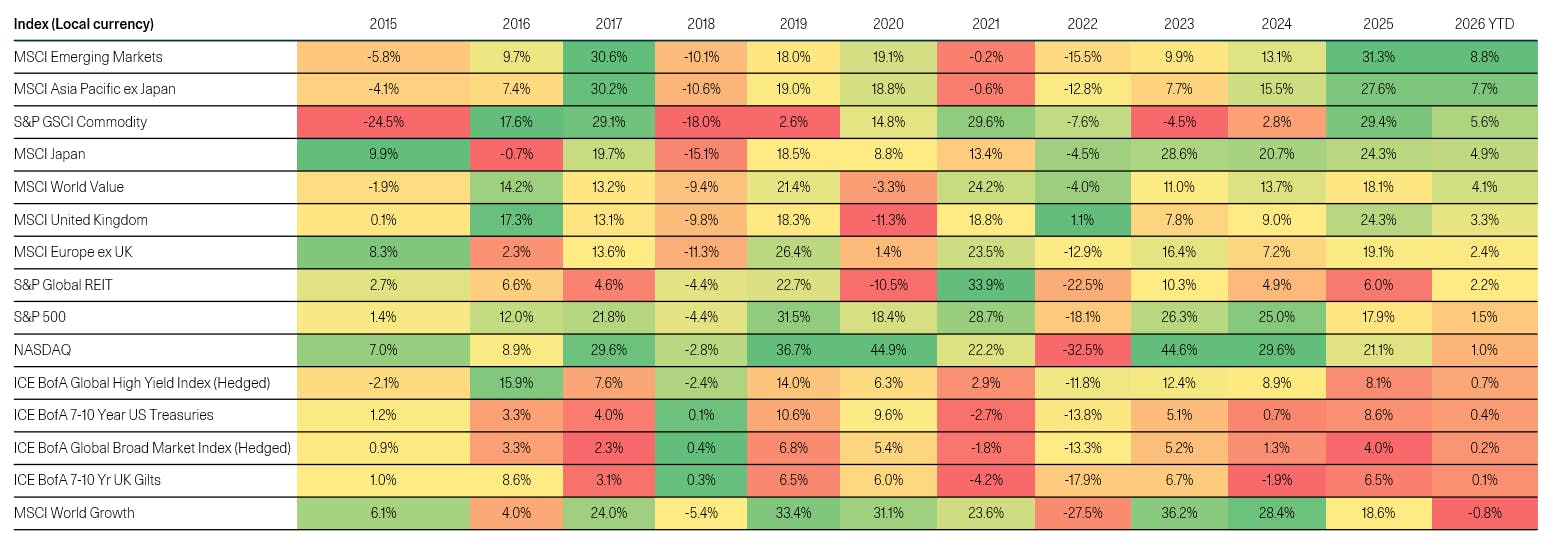

Global multi-asset performance data – local currency

Discrete annual, year-to-date and quarter-to-date

Source: W1M, MSCI, Bloomberg.

Could passive funds have a "lost decade"?

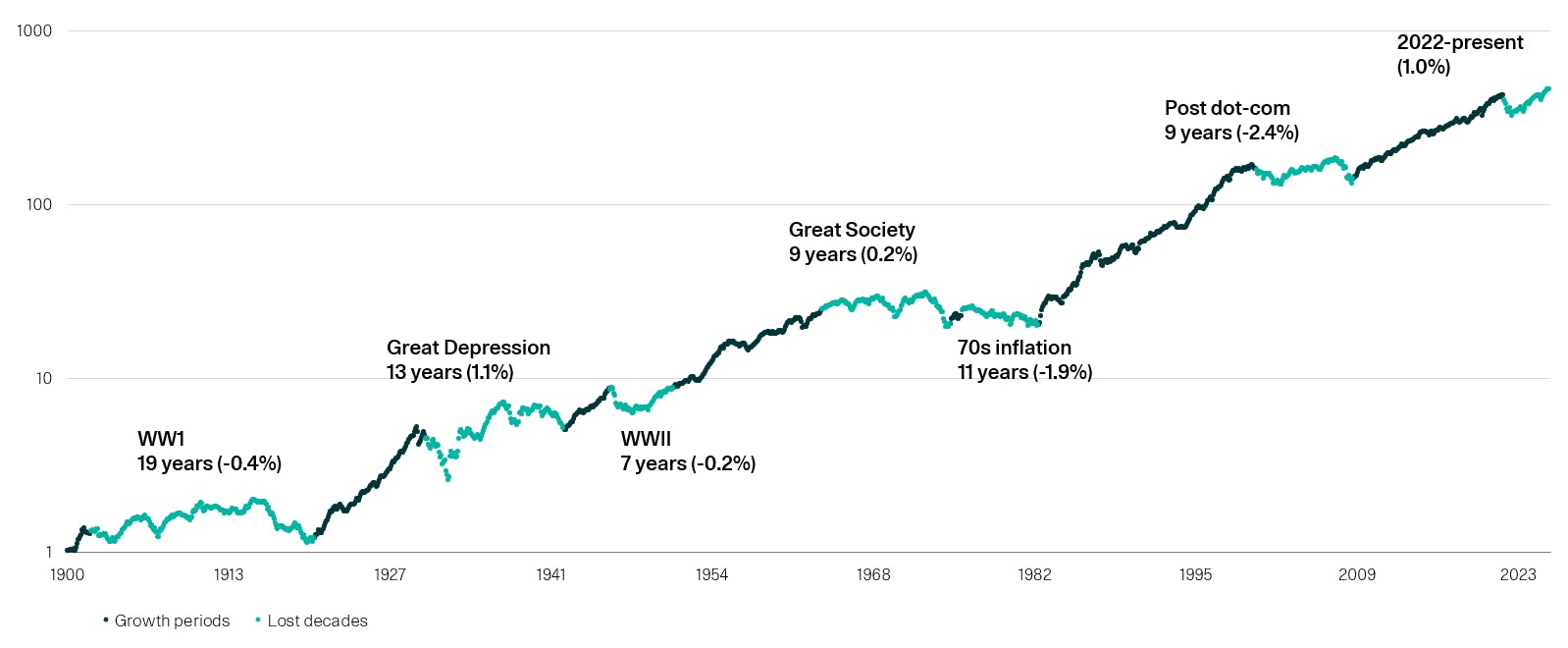

There has been a strong run in equities and that always makes passive investing, with a mix of indexed equity funds and bonds, look successful but they do not always outperform. When, for example, some stocks become very successful and large in market capitalisation terms, equity indices go up and passive strategies can do well. Momentum can dominate fundamentals for a long time. However, in other periods, equities and bonds can fall together. While they are normally expected to be diversifying, perhaps just when you need diversification most, equities and bonds can be correlated, and both deliver negative returns, for example when higher inflation surprises markets (as in 2022). It is easy to look at a long term chart and say the shorter term does not matter but how long is the “short term”? Keynes is supposed to have said that we are all dead in the long run. Many savers are not happy to be patient for years while investments disappoint. The chart below shows how a passive strategies can have very long periods when they can go sideways; this may surprise many. Sure, by the end of 2025, returns looked fine but would savers buying in 1995 have been happy with the value of their portfolio going sideways for 5 years? Post the dotcom crash and in the 1970s, there were even longer periods of passive strategies potentially being disappointing.

Passive 60/40 portfolios have endured 6 "lost decades" since 1900; could we be entering no.7?

Source: BofA, Bloomberg. As at 31.12.25. Note: 60/40 = 60% S&P 500 real total return and 40% US 10-year bond real total return.

After a strong period for equity performance, there can be a lot of faith in just being passive; history shows that faith may be stress-tested over a prolonged period. In a world with trade wars, tariffs, resulting inflation, the dominance of a few megacaps and ongoing geopolitical tensions, we are convinced that investors need to be global, active and properly diversified.

Active stock selection is more important when market indices are concentrated

We invest in companies where the market underappreciates the quality of the business. This can either be the long-term sustainability of high returns or the improving fundamentals. We call these “Compounders” and “Improvers”.

Source: W1M, Google Images. As at 31.12.25.

Inflation damaging the interest rate outlook, as in 2022, tends to be challenging for both bonds and equities and, therefore, for passive strategies. Currently, markets expect one or two small interest rate cuts in the US this year but even that is showing more concern regarding inflation; a year ago, more cuts were priced in. What has changed? One key change is that consumers are facing higher prices partly as a result of tariffs imposed in the last year. Companies, not countries, export and when they face tariffs, they naturally try to pass on as much of the cost of the tariffs as they can; the aim of the company is to make profits for its shareholders ultimately. So, to different degrees for different products, regardless of whether tariffs are American, European or Asian, they tend to be inflationary; they push prices up. That is inflation risk and as we go through this year, we may see exporters to the US seek to pass on more of the cost of tariffs to US consumers because it is observable that, so far, companies have absorbed some of those costs. Shareholders, however, do not tend to welcome weaker profit margins. So, one risk to passive strategies is that inflation surprises markets in a negative way this year.

Concentration is the term used to describe the situation when a few stocks are a relatively high percentage of a market’s value. Famously, some technology stocks have done incredibly well in the last decade and now constitute a significant percentage of the US equity market’s (S&P500) value. Some say this does not matter and concentration is visible in other markets too; it is true that the largest ten stocks in the FTSE100 or Cac40 are a significant weight in those indices but it is also true that a stock like Nvidia has a greater market capitalisation than the combined value of stocks in those indices. It does not matter so much if a small equity market is dominated by a few stocks but it does matter if the biggest equity market has that issue because if seven stocks are around a third of the S&P500, that means they represent around a fifth of global equity value. So, concentration risk matters, especially when it is in the largest and most important index globally because changes in sentiment can impact markets all over the world.

Concentration is often visible around market peaks; stocks that are the famous leaders in significant equity rallies are not necessarily able to keep their position, size and success. There were times when the new technology in the world was radio. Oil companies once dominated equity markets. Then, companies like Nokia looked unassailable as mobile phones and networks became essential… until Blackberry and Apple iPhones were developed. This last example shows that companies can be brilliant at what they do but others innovating can lead to significant change in their fortunes relative to new winners; that innovation is good for consumers ultimately but can lead to long market rotations. As mentioned above, after the last tech led rally, it took nearly a decade for the dotcom crash to wash out and in that time a passive strategy could have been negative. That is a long time to wait even if the position a couple of decades later looks fine. Concentration matters, especially when it is in the biggest global equity market.

Diversification with gold and other real assets matters

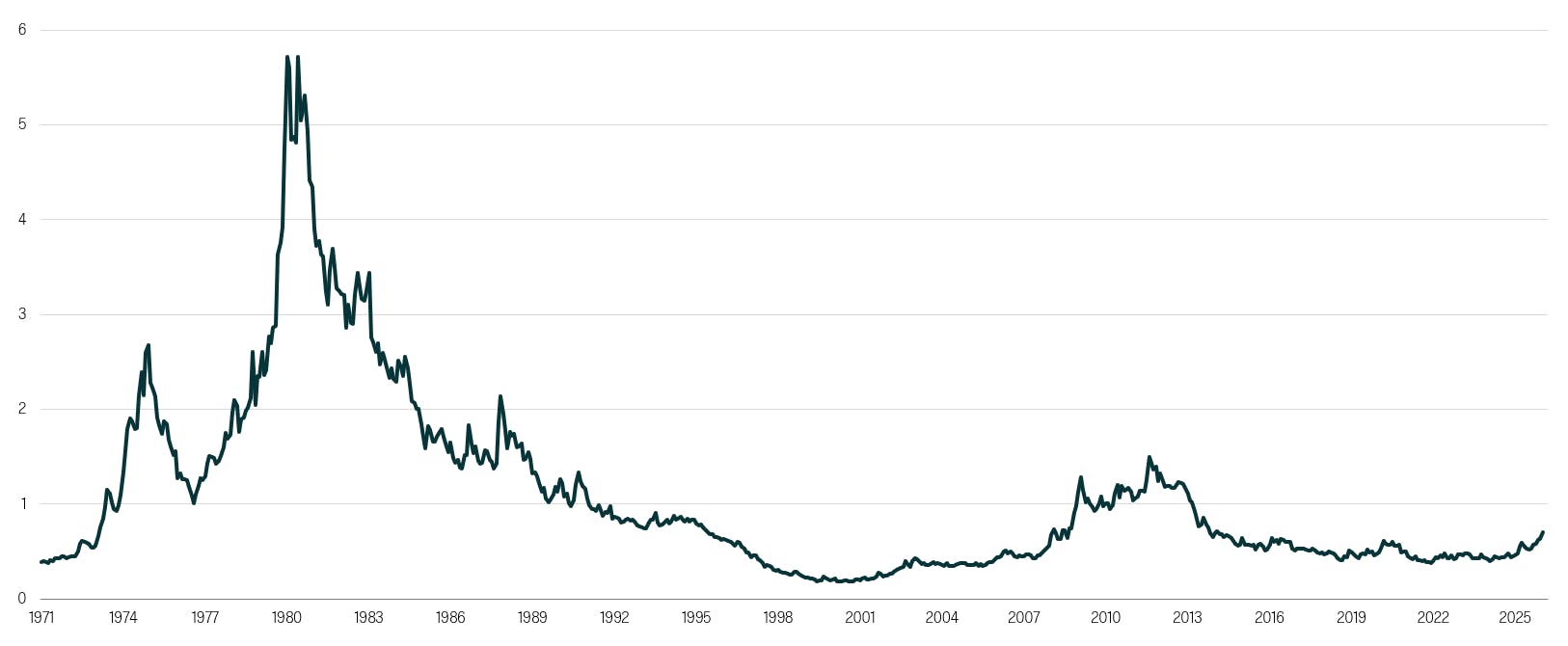

If passive strategies can have long periods of disappointing performance, the importance of diversification with more than equities and bonds is clear. Commodities are very useful in that they give inflation resilience as well as exposure to large trends such as demand for copper and uranium related to energy production and grid needs.

Long term commodity cycle showing signs of recovery

U.S Commodity Price Index (data 1795 to present) with major inflation peaks (red dots) and major inflation troughs (orange dots)

Source: Stifel, W1M, Bloomberg. As at 31.12.25.

Gold has been in the news a lot in the last year; we have written about our active strategy with the metal and gold miners here.

Looking at the gold price relative to US equities, it is hard to think that gold is “expensive” on a relative basis. Demand for real assets with inflation resilience and protection against fiat currency debasement (from money printing) remains a strong structural demand driver for assets like gold.

Gold price per troy ounce relative to S&P500 Index price - 1971 – current monthly

Source: Bloomberg, W1M. As at 31.01.26.

Conclusion

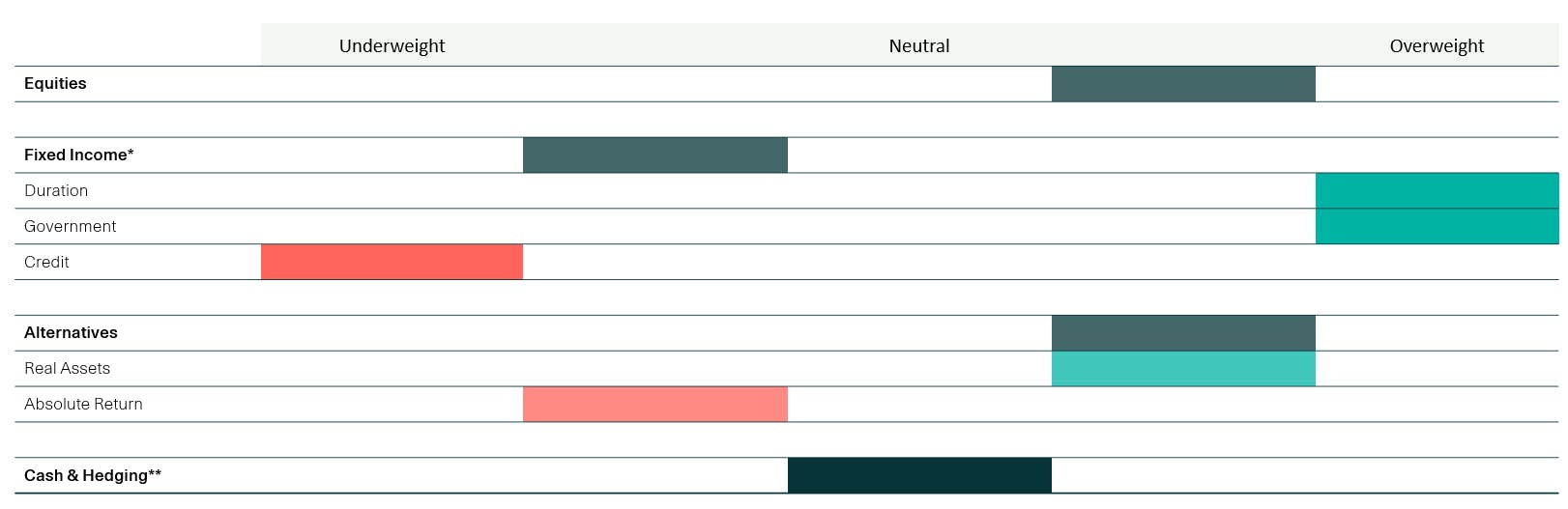

Owning every stock in the major indices, regardless of valuations, is not necessarily a good strategy, especially when some stocks are pricing in incredible growth which may not be delivered. We remain convinced it is right to be active in an environment where a small number of stocks now represent a significant part of the total market and geopolitical risks persist; our long term track record through various cycles shows the value of being active. We remain positively positioned in the equities we select because the big picture, growth and interest rate trajectories, remain supportive. Real assets offer diversification and inflation resilience. Bond markets, expecting modest US and UK interest rate cuts in the next year, have upside and we retain a preference for UK government bonds (gilts) relative to corporate debt. Proprietary protection strategies are a valuable and distinctive component of our portfolios in an uncertain world. After a volatile 2025, given geopolitical events already this year but also the many opportunities which exist, in our view the need is clear for investors to be properly diversified, global and active.

Summary of our views

February 2026 asset allocation positioning

*The table shows bond allocations relative to bond composite index.

**Hedging includes gold & Protection Strategy if possible.

Source: Morningstar. As at 21.01.26. The weightings are calculated as a percentage of the Waverton Balanced platform model portfolio and the peer group equivalent of Model GBP Allocation 40-60%. MSCI AC World weighting assumes a 60% allocation to equity. The above should be used as a guide only and is subject to change.

Chief Investment Officer, Bill Dinning's February Global Outlook can be found here.

Past performance is not a reliable indicator of future results. The value of investments and the income derived from them may rise as well as fall, and investors may not get back the amount originally invested. Capital security is not guaranteed.

This material is provided for informational purposes only and does not constitute investment advice or a recommendation. It should not be considered an offer to buy or sell any financial instrument or security. Any investment should be made based on a full understanding of the relevant documentation, including a private placement memorandum or offering documents where applicable. W1M Wealth Management Limited is authorised and regulated by both by the Financial Conduct Authority of 12 Endeavour Square, London E20 1JN, with firm reference number 120776 and the U.S. Securities and Exchange Commission of 100 F Street, NE Washington, DC 20549, with firm reference number 801-63787. Registered in England and Wales, Company Number 02080604.

All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without prior written permission from W1M Wealth Management Limited.

Copyright © 2026 W1M Wealth Management Limited.