The smart philanthropist: Why gifting assets beats gifting cash

When you decide to make a significant charitable donation, your first instinct is likely to reach for your bank card. However, for those with diversified portfolios, paying in cash might actually be the least efficient way to give.

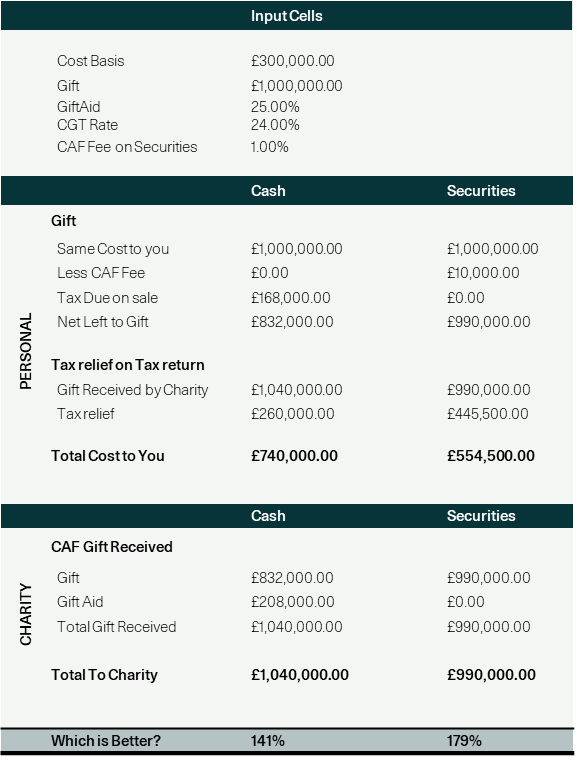

Data comparing cash donations to asset transfers (such as stocks or securities) reveals a startling gap in impact. As shown in the analysis below, gifting securities can be up to 38% more efficient than gifting cash. Here is why the "Securities Route" is becoming the gold standard for high-net-worth philanthropy.

The "Double Tax" trap of cash gifting

If you want to gift £1,000,000 to a charity but that money is currently tied up in shares, most people think they must sell the shares first. This creates a two-step tax hit:

Capital Gains Tax (CGT): When you sell the asset to realize the cash, you are immediately liable for CGT on the profit. In the example table, a sale of £1M worth of assets resulted in £168,000 in tax due, leaving only £832,000 available to gift.

Gift Aid Recovery: While the charity can claim Gift Aid (25%) on that remaining cash to bring the total gift back up to £1,040,000, the "Total Cost to You" remains high because you've already lost a massive chunk of your original capital to the taxman.

The power of direct asset transfers

When you gift qualifying securities (listed stocks, unit trusts, etc.) directly to a charity, the tax landscape changes completely.

CGT Exemption: You are not liable for Capital Gains Tax on assets gifted to charity. The £168,000 tax bill mentioned above simply vanishes.

Income Tax Relief: You can claim income tax relief on the full market value of the shares. This is a "below the line" deduction that significantly reduces your personal tax bill.

By the numbers: cash vs. securities

Based on the financial model provided, let’s look at the "efficiency" of a £1,000,000 commitment:

Cash vs assets

In this scenario, gifting securities costs you nearly £185,500 less out of pocket while still providing the charity with nearly a million pounds.

Why "179%" matters

The "Which is Better?" row in the table highlights a 179% efficiency for securities. This means for every £1 it actually costs you personally, the charity receives £1.79. In contrast, the cash method only provides £1.41 for every £1 spent.

By choosing assets over cash, you are effectively using the government’s tax incentives to "subsidize" your generosity. You aren't just giving more; you are giving smarter.

Key takeaway for donors

If you hold assets with significant capital gains, gifting them directly is almost always superior to selling them and donating the cash. You bypass the CGT trigger and maximize your personal income tax relief, allowing you to either keep more of your wealth or increase the size of your impact.

The timing of charitable donations can have a substantial impact on long-term tax efficiency. For a practical illustration across multiple tax years, see our Timing of charitable donations: cash vs. shares article.

This material is provided for informational purposes only and does not constitute tax, legal or financial advice and should not be relied upon as such. W1M and our affiliates do not provide legal or tax advice. Investors should consult their financial and tax advisors to assess the tax implications of any investment. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future.

The views expressed reflect current market conditions and are subject to change without notice. Any references to taxation are based on current understanding and may change.

This material is provided for informational purposes only and does not constitute investment advice or a recommendation. It should not be considered an offer to buy or sell any financial instrument or security.

Any investment should be made based on a full understanding of the relevant documentation, including a private placement memorandum or offering documents where applicable.

W1M Wealth Management and its affiliates do not provide legal or tax advice. Any references to taxation are based on current understanding and may change. Investors should seek independent tax advice tailored to their individual circumstances.