Should markets be spooked by Halloween?

Spooked by talk of stock market bubbles?

Some stocks are certainly “expensive” and around a third of the main US equity index’s weighting is dominated by just seven stocks. What goes up sharply can go down if the environment changes. We have written before about how we approach equity stock selection and, because we are not passive investors, we do not have to buy every stock in an index. This means we choose to avoid certain stocks on very high valuations and can, instead, focus on companies which are benefiting from the same themes. Being diversified always matters but being active and able to buy the best stocks globally regardless of their location is an advantage, we believe.

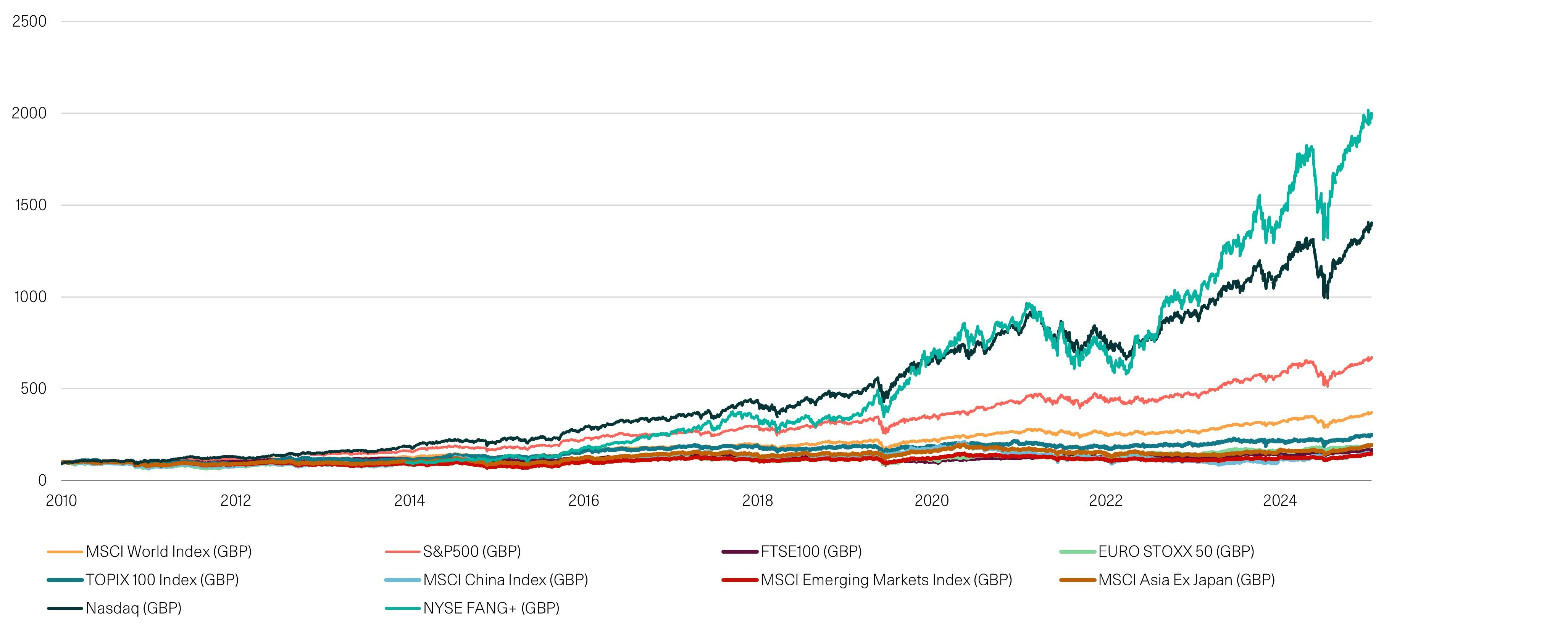

Equity index returns

Source: Bloomberg, W1M. Data as at 24.10.25

The chart above makes another point. Yes, some tech stocks have done extremely well. But hindsight with investing can be dangerous. Investors should always remember their objectives and appetite for risk at the outset of investing. It’s clear from the other market indices that across the board the long-term investor has done well, even through years with many challenges from pandemics, war in Europe and trade wars. Being long term, focused on your objectives and favouring risk adjusted returns allows investors to not be worried by inevitable short-term fluctuations or look back on performance with envy.

Spooked by talk of trade wars?

Normal market concerns (growth, inflation, interest rates) have been somewhat dwarfed by tariff war worries at points in the last year. The US election was won with the promise of tariffs to protect US jobs and there has been some success in getting foreign companies to invest more in US production. The problem with tariffs is that they create what is effectively a tax on consumers and not just on exporters. So, somebody has to pay around $350bn a year and that burden will fall to a lesser or greater extent on US consumers depending on what companies can pass on in price increases. This could harm demand but also is, obviously, inflationary. Bond markets have, as usual, been ahead of equity markets in recognising inflationary risks with both US and UK bond yields remaining higher than their governments would like, which is a constraint on interest rate cuts. But, since the summer, diminishing market concern about inflation, perhaps because of more evidence of labour market weakness implying that growth is slowing, has been evident. In addition to this, trade deals are being done and the market is expecting China and the US to get to an agreement soon given a trade war is in neither economy’s interests. (The UK, being independent in its trade policy now, has struck a better deal with the US than the EU and has also done deals with India and others.)

US Customs Duties Revenues, US$ billion, 2010-2025 monthly

Source: US Treasury, State of U.S. Tariffs: July 28, 2025 | The Budget Lab at Yale W1M. As at 06.08.25

Spooked by what may be coming up in the Budget?

Nobody knows exactly what will be in the UK budget but everyone knows growth is sluggish, borrowing and the tax burden are already high, while productivity remains disappointing. These are, however, not problems unique to the UK; the US actually has a larger fiscal deficit than the UK while France seems to be in the middle of much more political drama; but the US has the world’s reserve currency and a more dynamic economy with far higher average incomes. We have argued that some in the media have been too negative on the UK and it has been pleasing to see UK bond yields fall (which is like the interest rate falling on government debt); this is consistent with our thesis of no imminent UK fiscal crisis but deficits are likely to ease gradually over the next few years IF the government can achieve a path of reducing spending while raising more taxes.

Reasons not to hide behind the sofa this Halloween

Global growth remains positive. Interest rates are set to fall in the next year with quite a few US interest rates cuts priced in. It is still possible to find lots of great stock ideas around the world; even in the US, not all equities are expensive.

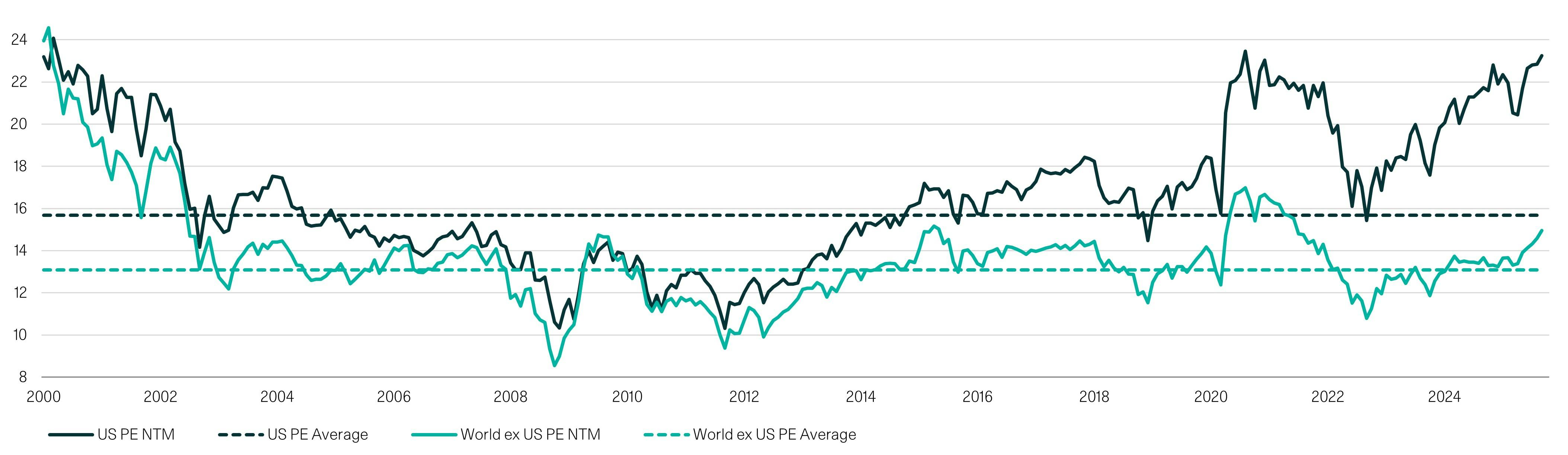

US equities are not necessarily expensive

MSCI US and MSCI Global ex US price–earnings ratio based on next 12 months earnings

Source: MSCI, FactSet, W1M. As at 30.09.25

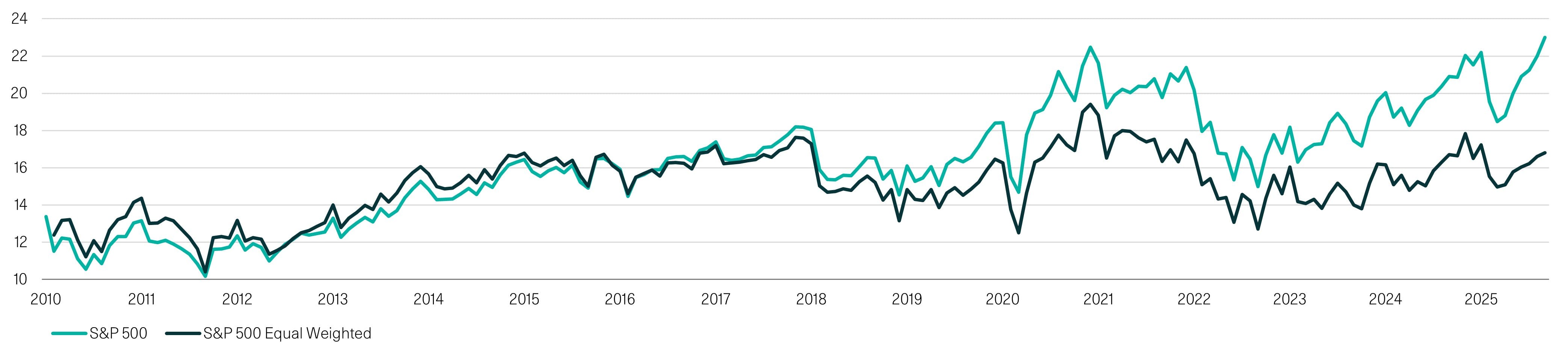

S&P500 Index and S&P500 Equal Weighted Index, price earnings ratio 2010 - current

Source: Bloomberg, W1M. As at 30.09.25

Be long term and well diversified

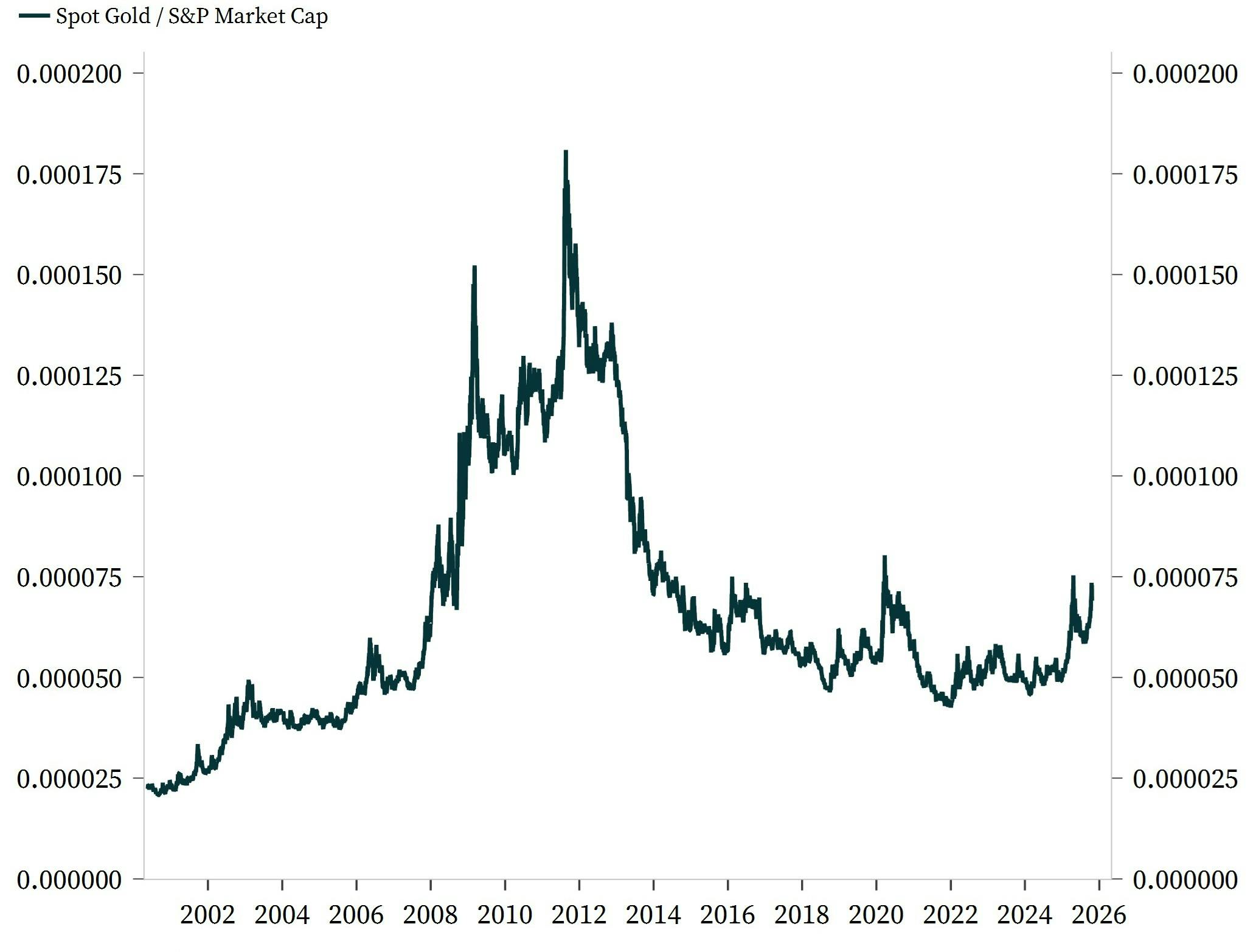

Crucially, W1M multi asset portfolios are diversified across more than equities and bonds (which can fall together as seen in 2022) . One example of this is having exposure to real assets including gold and property as well as deploying absolute return strategies.

Gold and gold miners have had a great year but the long term structural story for the metal price remains intact given miners have not really increased production and are not, therefore, destroying the very healthy margins they are now enjoying. In addition, there are non-price-sensitive buyers of gold, such as central banks, who are not trying to make a profit but just hold fewer US dollars or government bonds so they buy gold regardless of the price; demand remains strong while supply is not responding, this is very positive for prices. The chart below also shows that the gold price is far from stretched relative to equities currently; this implies more investment related demand for gold is quite possible. And while bitcoin may be digital gold, it is obviously a lot easier for most funds to accept holding the real thing.

Gold Price % of Equity Assets

Spot Gold % of S&P 500 Market Cap

Source: Bloomberg

Past performance is not a reliable indicator of future results. The value of investments and the income derived from them may rise as well as fall, and investors may not get back the amount originally invested. Capital security is not guaranteed.

This material is provided for informational purposes only and does not constitute investment advice or a recommendation. It should not be considered an offer to buy or sell any financial instrument or security. Any investment should be made based on a full understanding of the relevant documentation, including a private placement memorandum or offering documents where applicable. W1M Wealth Management Limited is authorised and regulated by both by the Financial Conduct Authority of 12 Endeavour Square, London E20 1JN, with firm reference number 120776 and the U.S. Securities and Exchange Commission of 100 F Street, NE Washington, DC 20549, with firm reference number 801-63787. Registered in England and Wales, Company Number 02080604.

All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without prior written permission from W1M Wealth Management Limited.

Copyright © 2025 W1M Wealth Management Limited.