Real Assets: Uranium and growing demand for nuclear energy

Real Assets investing means much more than holding gold and property at W1M. In our Real Assets fund (a key “building block” in our multi asset solutions), we hold a range of investments with the aim of giving portfolios diversification and inflation resilience. Key themes as we look into the future, also offer great return opportunities.

This year, in addition to holding gold and gold mining exposure, Luke Hyde-Smith and team added Cameco to the fund, giving it uranium exposure; there is significant global interest in gaining more nuclear energy capability for environmental and energy security reasons. At the end of October, it was announced that Westinghouse, jointly owned by Cameco and Brookfield signed a partnership agreement with the U.S. government to help build nuclear reactors in the USA.

As we invest in the future with the Real Assets fund, you can see below a range of exposures related to energy security and renewables - from uranium with Cameco, to decarbonisation plays like Brookfield Renewable Partners, to power generation and grid companies such as Iberdrola and Vinci.

Investing in the future

The fund is positioned across key areas benefiting from grid modernisation, power demand and renewable buildout:

- Grid

- Power

- Decarbonisation

Source: Company websites, W1M. Data as at 30th June 2025.

Risk warning: The above is for example purposes only and should not be considered a solicitation to buy or sell a security.

As we think about commodities and the huge amount of capital investment needed in housing, electricity grids and power generation and AI related data centres, we think commodities could enjoy a positive demand-led environment from here, having already enjoyed some recovery.

Long term commodity cycle showing signs of recovery

U.S. Commodity price index (data 1795 to present) with major inflation peaks (red dots) & major inflation troughs (orange dots)

Source: Stifel, W1M, Bloomberg. As at 30.09.25.

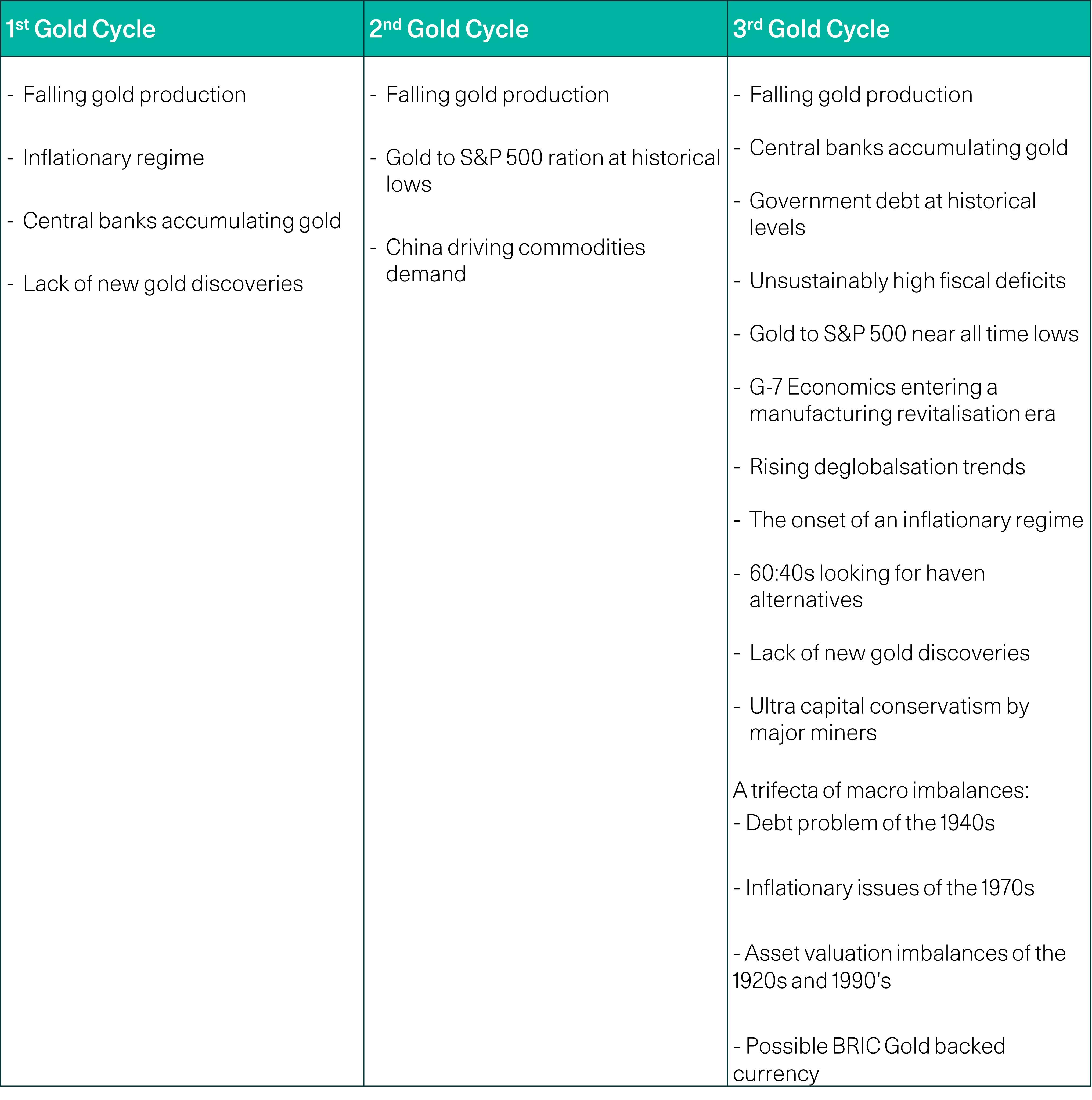

Generally, we would not necessarily be put off by some good returns in the last year. Looking at gold, there are good reasons to believe that it could be entering a new bull market. Demand from central banks for gold is strong and they are not primarily price-sensitive buyers but trying to diversify their holdings away from fiat currencies and perhaps the US dollar. Happily, for their profit margins, gold production is not showing any significant increase and that could help gold to rise even further.

Gold - Entering a new bull market?

The history of gold cycles

Source: Bloomberg, Tavi Costa. As at 30.09.25.

Risk warning: Past performance is no guarantee of future results

Gold is also not necessarily expensive when compared to equities. The graph below shows that gold is far from relative levels versus equities last seen in the Global Financial Crisis. Should any market correction arrive, even from current levels, gold could give investors significant protection. But, it is not the only metal we are interested in and October ended with uranium taking a little of the market spotlight.

Gold price % of equity assets

Spot gold % of S&P 500 market cap

Source: Bloomberg

Past performance is not a reliable indicator of future results. The value of investments and the income derived from them may rise as well as fall, and investors may not get back the amount originally invested. Capital security is not guaranteed.

This material is provided for informational purposes only and does not constitute investment advice or a recommendation. It should not be considered an offer to buy or sell any financial instrument or security. Any investment should be made based on a full understanding of the relevant documentation, including a private placement memorandum or offering documents where applicable. W1M Wealth Management Limited is authorised and regulated by both by the Financial Conduct Authority of 12 Endeavour Square, London E20 1JN, with firm reference number 120776 and the U.S. Securities and Exchange Commission of 100 F Street, NE Washington, DC 20549, with firm reference number 801-63787. Registered in England and Wales, Company Number 02080604.

All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without prior written permission from W1M Wealth Management Limited.

Copyright © 2025 W1M Wealth Management Limited.