MPS rebalancing and the beauty of simplicity

Recent industry press coverage has homed in on the management and administration of Managed Portfolio Services (MPS), with operational inefficiencies and errors under heightened scrutiny, in part due to The Consumer Duty and associated client outcomes.

A report from NextWealth, covered in Money Marketing, Citywire and Professional Paraplanner among others, highlighted that disjointed management across various platforms leads to unreliable outcomes, affecting client satisfaction and investment returns.

The articles explain how MPS rebalancing often incurs unnecessary costs and can take up to 100 hours for firms to complete, across multiple platforms, with calls for an operational shake-up to enhance efficiency and deliver better outcomes for clients, stressing the importance of a cohesive management strategy.

Waverton's MPS: A market outlier...

A traditional MPS uses a portfolio of funds approach, which involves paying a manager to coordinate a selection of third-party funds, all of which have their own managers, investment philosophies and fees.

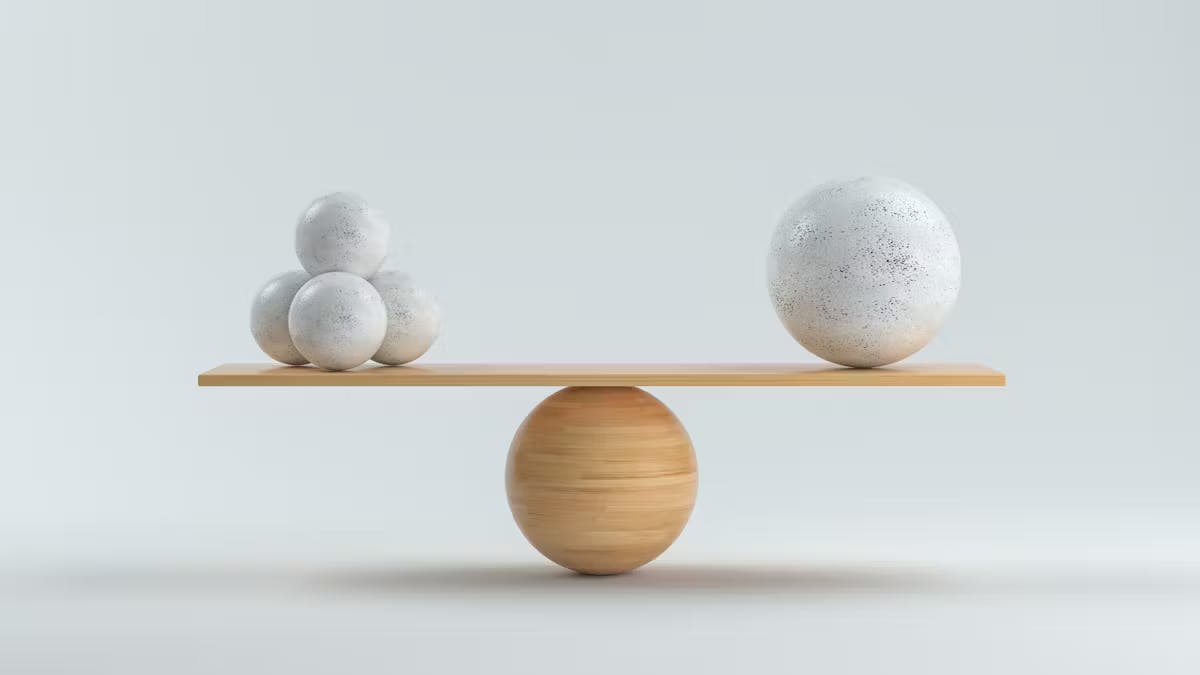

Waverton's MPS has a genuinely innovative structure, comprised of four ‘building block' funds which are run by our dedicated investment team. We then offer six mandates which hold different proportions of these funds to cater for different risk profiles. These weightings can then be easily adjusted when deemed necessary, with minimal friction as we can usually rebalance all portfolios, across all platforms, on the same day. This structure also results in a lower portfolio turnover rate, which can lead to fewer CGT crystallisation events for clients.

In addition to providing full clarity on what we own (and importantly what we choose not to own) and what the known risks are, the building block structure also allows for consistency across a wide range of platforms (as we only need to ensure the availability of our four OEICs). For other managers, a particular component fund might not be available on all required platforms. They could then be forced to compromise by either selecting a substitute that is available across all platforms, or resort to buying different funds on different platforms which would affect the consistency of client outcomes.

In conclusion, Waverton’s MPS enables consistent delivery and efficient trade execution across platforms. Using a global, active and direct investment philosophy, it is attractive to clients who may desire a greater engagement with and understanding of their portfolio. For advisers seeking to broaden their range of investment solutions, Waverton offers a natural diversifier to passive solutions and more traditionally allocated managers. The MPS structure enables the delivery of our best investment ideas with efficiency and consistency, thereby supporting great customer outcomes.