Investing now with equity markets near all-time highs?

The W1M Equities team hosted a webinar to discuss our approach to equity investing when markets are around all time highs. There is currently a lot of debate in the media about equities being “expensive” and “AI bubbles”. Such debates are probably most relevant for competitors using index funds.

The W1M equity team addressed these issues, describing how stock selection is approached at W1M; we continue to find strong investment ideas in all regions globally as we look for “Compounders” and “Improvers” with attractive medium to long term opportunities.

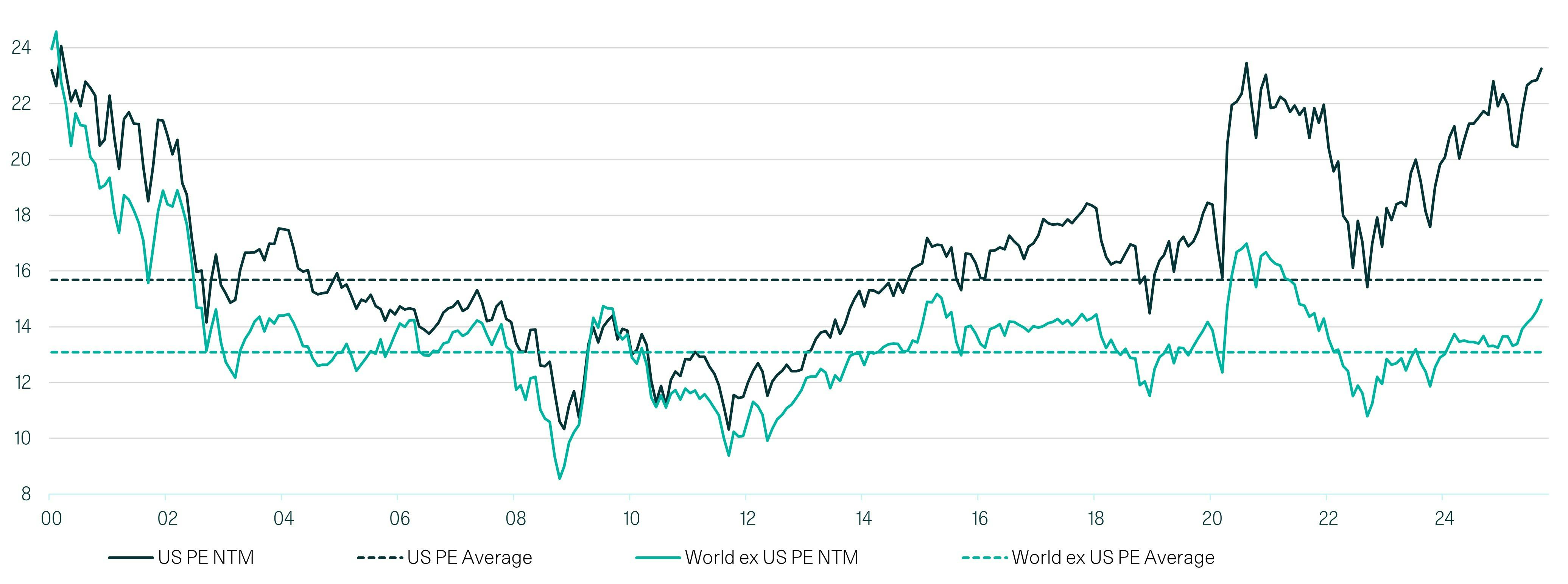

US stock market valuation premium persists

MSCI US and MSCI Global ex US price–earnings ratio based on next 12 months earnings

Source: MSCI FactSet, W1M. As at 30.09.2025

It has, of course, been possible to describe US stocks as more expensive than European or Emerging Markets for many years but that has not stopped exceptional outperformance by US indices. For fully active investors such as W1M, not buying index funds but selecting stocks we believe strongly in based on our research, any market looking expensive is not necessarily relevant as we are able to find stocks in all regions which appear attractive to us over 3 to 5 years. We are global, direct, active … and aiming to deliver over the medium and longer term.

Our investment approach

W1M’s Head of Equities, Jennifer Fisher talked about how W1M looks at stocks in terms of two broad groups.

Compounders are companies with strong barriers to entry and profitability for which we multi-year success. Such companies ought to be more expensive than average given their inherent quality. Examples of Compounders include GE Aerospace and a Chinese company called CATL which we will discuss more below.

Improvers are companies where we see a path to improving returns; this could come from management changing direction to focus a business on its strongest activities or making it more efficient, or from industry consolidation reducing oversupply in a sector and allowing better profitability to emerge. Cardboard industry consolidation has given us one such opportunity in Smurfit Westrock which we will refer to below.

How do we find opportunities?

Seeking to identify companies where the market underappreciates the quality of the business

Benjamin Hall, Asia Pacific Fund Manager, discussed CATL, a “compounder” which is a global leader in battery technology. China is not just a very competitive manufacturer these days but also a strong innovator and CATL has nearly a 40% market share in lithium-ion batteries supplied to electric vehicle manufacturers and as part of the energy storage systems sold to power utilities. The CEO owns a large stake in the company making his interests align with those of external shareholders. We do not own Tesla but looking at the global electric vehicle sector, CATL is an attractive and profitable “compounder” in our view. If stocks like Tesla are considered “expensive”, not buying index funds but being active allows W1M to hold stocks like CATL which have been delivering strongly and have advantages to suggest they should be able to deliver for the foreseeable future. More details on the Waverton Asia Pacific Fund.

Christopher Garsten, European Fund Manager, discussed how industry consolidation can help stocks to feature on our “Improver” list. Packaging and cardboard is maybe more a part of life these days with online shopping and millions of deliveries every day but the industry has not always been attractive because it was fragmented. Seeing capacity going out of the global industry was a signal to us that profits could improve for the large players such as Smurfit Westrock. More details on the Waverton European Capital Growth Fund and the Waverton Dividend Growth Fund.

George Williams, Global Equity Fund Manager, discussed the US freight market coming out of a weak period and our holding in a railroad called Canadian Pacific Kansas City (CPKC) which operates the only single-line transnational rail network connecting Canada, the United States, and Mexico, providing freight transportation services across the continent. The barriers to entry in that market are clear to see given any competitor is going to find it quite difficult to replicate the railroad CPKC have. A recovering freight market allows CPKC to expect its profits to grow. While the market is currently focused on the risk of an AI bubble, other parts of the US market are just emerging from a multi-year downturn. More details on the Waverton Global Equity Fund.

W1M equity portfolios do not hold hundreds or thousands of stocks, as some competitors do. We look at global sectors and aim to buy the companies we consider have the best 3-5 year prospects based on our fundamental research. This leads to our equity exposure being less exposed than passive funds to market “heavyweights” such as the largest technology stocks and W1M holding stocks, whether “Compounders” or “Improvers” in which we have high conviction.

Past performance is not a reliable indicator of future results. The value of investments and the income derived from them may rise as well as fall, and investors may not get back the amount originally invested. Capital security is not guaranteed.

This material is provided for informational purposes only and does not constitute investment advice or a recommendation. It should not be considered an offer to buy or sell any financial instrument or security. Any investment should be made based on a full understanding of the relevant documentation, including a private placement memorandum or offering documents where applicable. W1M Wealth Management Limited is authorised and regulated by both by the Financial Conduct Authority of 12 Endeavour Square, London E20 1JN, with firm reference number 120776 and the U.S. Securities and Exchange Commission of 100 F Street, NE Washington, DC 20549, with firm reference number 801-63787. Registered in England and Wales, Company Number 02080604.

All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without prior written permission from W1M Wealth Management Limited.

Copyright © 2025 W1M Wealth Management Limited.