Credit valuations at a Crossroads

There has been an ongoing debate over whether credit markets are fundamentally strong enough to justify their tight valuations, and how investors should position in light of that. In this article, we explore both sides of the argument: the case for staying invested in credit and the reasons some investors are taking a more cautious stance.

At W1M, we believe that valuations, in aggregate, do not fully reflect the balance of risks in credit markets. However, for active managers, carry opportunities still exist from corporates with strong balance sheets. As such, we maintain a moderate allocation to selective credits within our managed portfolios.

Reasons to stay positive on credit

1) Solid fundamentals

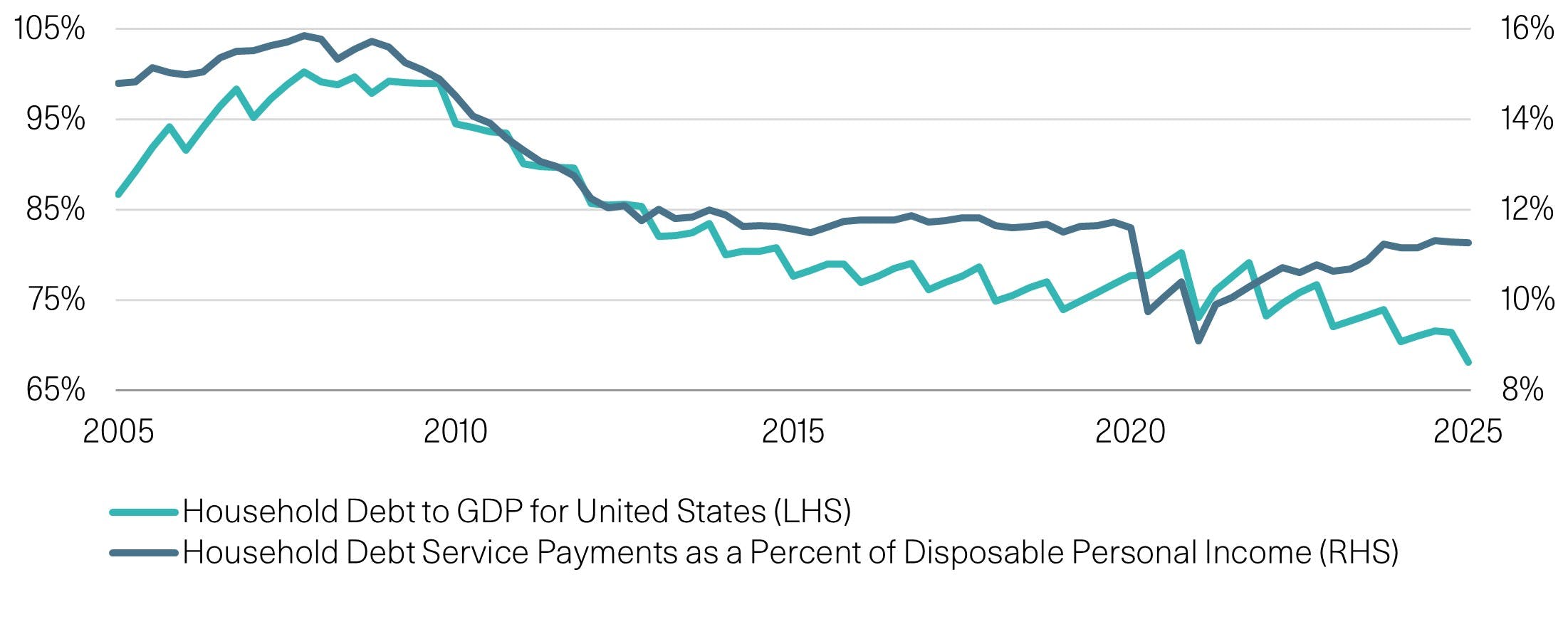

Both household and corporate fundamentals have shown impressive resilience in the face of higher interest rates. Household debt as a percent of both household income and GDP has been on a downward trend since the Global Financial Crisis, and interest costs as a share of disposable income remain below long-term averages. While the labour market is beginning to cool, unemployment remains low. This combination has supported the consumer – the main engine of the US economy – and in turn has underpinned robust earnings growth and margin expansion for companies.

That strength is reflected in both economic growth data and equity markets, which continue to trade near record highs. However, the higher-for-longer rate environment has begun to weigh on corporates: interest coverage ratios have fallen as debt is refinanced at higher costs, and indebtedness ratios (leverage) have been trending upwards. For now, though, these remain at levels that are not yet cause for concern, with both implied and realised credit spread volatility remaining well below that of interest rate volatility.

Figure 1: US Household Debt Burden

Source: Federal Reserve Bank of ST.LOUIS, W1M, Data as of 23 October 2025

2) Supportive supply-demand dynamic

Investor demand for credit has remained supportive in the post-pandemic period. Higher ‘all-in yields’ – the result of aggressive central bank rate hikes – have attracted a broad base of yield-seeking investors. Yet net supply has remained subdued. Beyond routine refinancing, many companies have adopted a wait-and-see approach, remaining cautious about tapping the bond markets for new funding. The combination of steady demand and subdued supply, together with stable corporate fundamentals, has pushed credit spreads toward historical lows.

Reasons to be cautious about credit

1) Record tight spreads

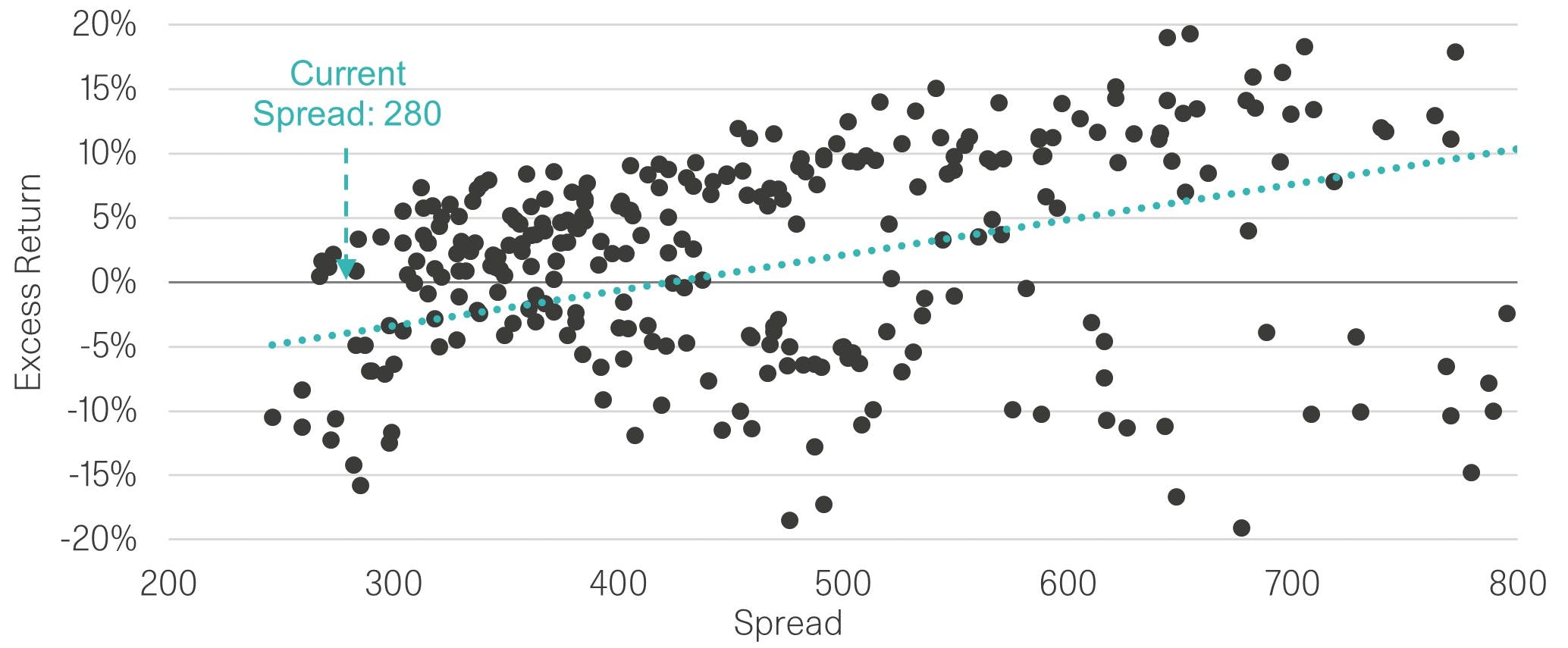

When we look beneath the surface, much of the attractive ‘all-in yield’ from credit comes from the government bond component. In contrast, credit spreads, the extra compensation investors receive for taking on credit risk, have tightened to near record lows. In simple terms, investors are not being paid enough of a risk premium to justify moving from government bonds into credit.

Historical data support this view. When US investment grade spreads have previously been at current levels, the sector has tended to underperform Treasuries over the following year by around 1.9% on average. The pattern is even clearer in high yield, where similar conditions have historically led to an average underperformance of roughly 6.2%.

Figure 2: US High-Yield Credit Spreads vs 12-month Excess Returns Over US Treasuries

Source: ICE BoFA, W1M, Data as at 23 October 2025

2) Default rates remain elevated

Default rates on loans and high-yield bonds remain above long-term averages. The recent collapses of First Brands and Tricolor, while largely idiosyncratic, ring a warning bell about the riskiness of high-yield credit. Cracks are beginning to appear in the riskier segments of the credit market, although corporates are generally in good shape. As Jamie Dimon recently said, “When you see one cockroach, there are probably more.”

Ultimately, credit spreads reflect the risk of default - the compensation investors receive for bearing that risk. With default rates still elevated, current record-tight spreads appear inconsistent with underlying credit risk, providing a clear reason for caution.

Bottom line

We continue to favour government bonds over credit from a valuation standpoint, given the attractive real yields and the backdrop of a potential rate-cutting cycle.

However, this doesn’t mean we will simply sit on the sidelines and wait for a major correction in the credit markets, even if valuations appear expensive. We believe opportunities exist at the shorter end of the credit curve, where spread duration can be minimised while still capturing attractive yields. We remain active in identifying idiosyncratic opportunities through bottom-up analysis. The recent re-launch of our Global Credit Opportunities Fund allows us to capture opportunities across the corporate bond universe throughout the cycle.

Past performance is not a reliable indicator of future results. The value of investments and the income derived from them may rise as well as fall, and investors may not get back the amount originally invested. Capital security is not guaranteed.

This material is provided for informational purposes only and does not constitute investment advice or a recommendation. It should not be considered an offer to buy or sell any financial instrument or security. Any investment should be made based on a full understanding of the relevant documentation, including a private placement memorandum or offering documents where applicable. W1M Wealth Management Limited is authorised and regulated by both by the Financial Conduct Authority of 12 Endeavour Square, London E20 1JN, with firm reference number 120776 and the U.S. Securities and Exchange Commission of 100 F Street, NE Washington, DC 20549, with firm reference number 801-63787. Registered in England and Wales, Company Number 02080604.

All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without prior written permission from W1M Wealth Management Limited.

Copyright © 2025 W1M Wealth Management Limited.