31st January - UK tax return filing and payment

The 31st January 2026 is the deadline for filing your 2024-25 UK tax return, settling any tax liability for the year, and making any payments on account for the current 2025-26 tax year.

If you have received investment income and capital gains in the period from 6 April 2024 to 5 April 2025, you may have a corresponding tax liability to settle.

There are some planning considerations to think about if you need to make these payments and we have covered these below.

Cash or investments?

Should you use existing cash or raise cash from investments?

This will depend on the size of the withdrawal. Target cash levels are below 3% for portfolios so if there is enough cash to facilitate the withdrawal then take from cash. If the withdrawal is material, say 10%, then cash may need to be raised from investments. Tax implications and trading costs are considered while being mindful of not negatively affecting the client’s risk profile/asset allocation. Typically, the portfolio manager will proportionately raise cash across all asset classes, such that post withdrawal the asset allocation is the same. Keeping trading costs to a minimum without affecting the client’s overall investment strategy is important, as are the tax implications of selling down positions with material gains/losses. Therefore, portfolio managers will liaise with the advisor to understand the client’s tax and individual circumstances.

Is now a good time to sell? Equities vs Fixed Income

From an investment perspective, it depends on the time horizon. Currently, as an investment house for balanced portfolios, W1M has a slight overweight stance on equities and has a preference for sovereign debt over corporate bonds. Equity markets have performed well, though valuations in a few tech companies continue to look stretched as AI euphoria pushes their share prices higher. There remain opportunities outside of these names in sectors such as industrials. Credit spreads have narrowed, leading to the risk-reward payout for sovereign bonds to be more attractive than corporate bonds.

As discussed above, when it comes to raising cash, choosing one asset class over another will depend on size of withdrawal, tax implications and trading costs.

Finally, another consideration is currency. At the time of writing, GBP/USD is at 1.31 and we have seen significant volatility in FX markets this year given the changing geopolitical and monetary landscapes. For clients with multi-currency portfolios, this can make the timing of raising cash while being cognisant of realising gains increasingly complex.

How long can it take to raise cash especially if you need to consider currency conversions as well?

It is important to consider how long it can take to sell investments to raise cash, especially if the investments are in a different currency to sterling. This is so that cash can be available ahead of the deadline so that any payments can be made on a timely basis.

W1M strategies are highly liquid which means all securities purchased have daily liquidity. Our high-quality bias investment process screens for global brands and systematically important institutions which are traded on regulated exchanges. Direct equities and bonds will usually settle in two days from the trade date while US and UK government bonds typically settle in one day. Converting from a different currency into sterling is a regular occurrence and the process will vary on the timing of the withdrawal. The process is fluid and examples of converting to sterling immediately, in tranches or ahead/after macro data is a strength of W1M’s approach.

2025-26 Payment on account

Bear in mind that if you are selling assets now in the 2025-26 tax year, this could also impact the amount needed for your first payment on account also due by 31st January 2026.

Considerations for taxpayers in Scotland

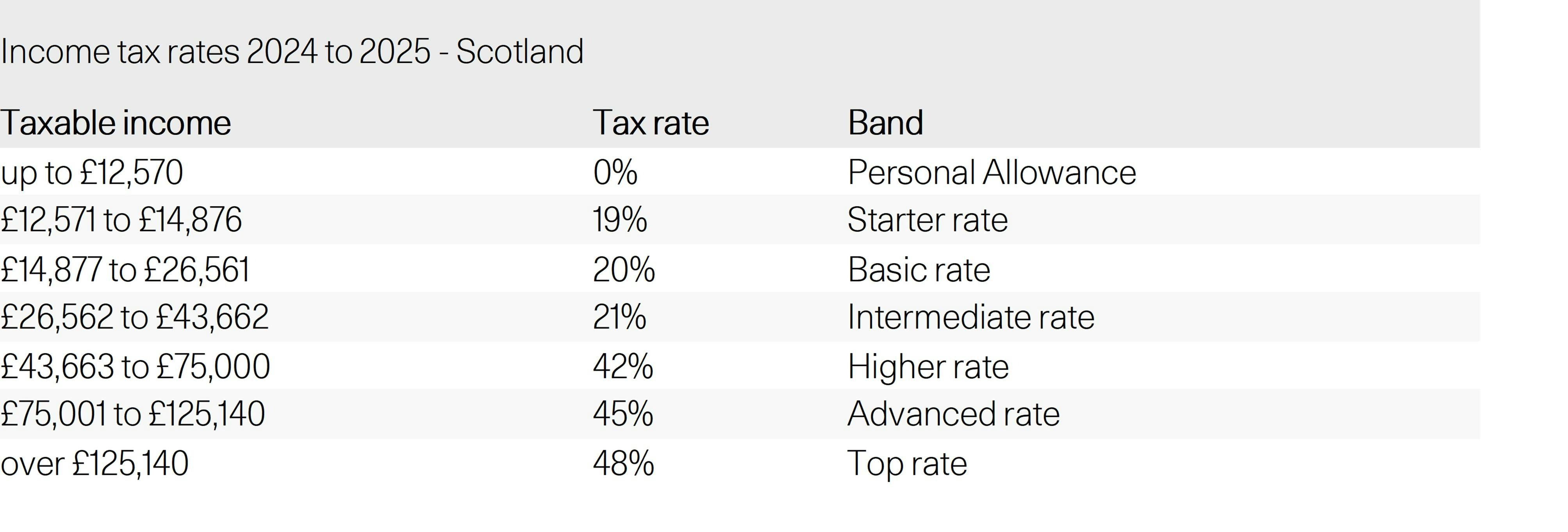

Scottish taxpayers should be aware that they are subject to six tax bands rather than the three that exist elsewhere in the United Kingdom.

These are the rates for the 24/25 tax year:

Scottish taxpayers should ensure their Scottish taxpayer status is correctly logged with HMRC. For employed individuals, this is usually indicated by an 'S' prefix at the beginning of your tax code. Scottish taxpayers should also pay attention to any extra forms they may need for more complex tax situations.

Considerations for US taxpayers

If you are a US taxpayer, you may have already made your UK tax payment ahead of 31st December for foreign tax credit purposes. However, if you still need to make a UK payment, you also need to consider that any trades being placed will now fall into the new 2025 US tax year.

You may have loss and foreign tax credit carryovers but note that these might be utilised for 2024 once your US taxes have been finalised for the year. Nevertheless, now is a great time to consider realising gains or losses, as you have additional time to balance this position out.

If investments need to be sold to raise cash, it is important to understand the position in both USD and GBP terms. This is because you might have a gain in sterling, for example, but the opposite might be true once you convert the position to USD.

If you are a client of W1M, then this is something we will do for you ahead of placing any trades. This is because our systems and reporting assess the position in both USD and GBP.

Past performance is not a reliable indicator of future results. The value of investments and the income derived from them may rise as well as fall, and investors may not get back the amount originally invested. Capital security is not guaranteed.

This material is provided for informational purposes only and does not constitute investment, recommendation, tax, legal or financial advice and should not be relied upon as such. It should not be considered an offer to buy or sell any financial instrument or security. Any investment should be made based on a full understanding of the relevant documentation, including a private placement memorandum or offering documents where applicable.

W1M and our affiliates do not provide legal or tax advice. Investors should consult their financial and tax advisors to assess the tax implications of any investment. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future.

The views expressed reflect current market conditions and are subject to change without notice. Any references to taxation are based on current understanding and may change.